USAA online car insurance quote offers a convenient and personalized way to get an estimate on your car insurance premiums. As a member-owned financial institution, USAA caters specifically to military members, veterans, and their families, understanding their unique needs and providing tailored coverage options.

Table of Contents

With USAA’s online quote tool, you can quickly and easily compare rates, explore different coverage levels, and find the best policy for your individual situation. This tool allows you to enter your information and receive an instant quote, without the need for lengthy phone calls or in-person visits.

USAA Online Car Insurance Quote Overview

USAA’s online car insurance quote system provides a convenient and efficient way for eligible members to obtain personalized insurance quotes. It simplifies the process of comparing different coverage options and finding the best rate for their needs.

The online quote tool is designed to be user-friendly and accessible, allowing members to receive a customized quote within minutes. It guides users through a series of questions, gathering information about their vehicle, driving history, and desired coverage levels.

Key Features and Benefits

The USAA online car insurance quote tool offers several features and benefits that enhance the quoting experience for members:

- Instant Quotes: Members can receive a real-time quote based on their specific information, eliminating the need for lengthy phone calls or in-person appointments.

- Personalized Quotes: The tool tailors quotes to individual circumstances, considering factors such as vehicle type, driving history, and desired coverage levels.

- Multiple Coverage Options: Members can explore various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Easy Comparison: The tool allows members to compare different quotes side-by-side, making it easy to identify the best option for their needs and budget.

- Secure and Confidential: USAA prioritizes the security and confidentiality of member information, ensuring a safe and protected quoting experience.

Target Audience

USAA car insurance is primarily targeted towards active-duty military personnel, veterans, and their families. This specific target audience has unique needs and priorities, which USAA caters to through its insurance products and services.

- Military Lifestyle: USAA understands the unique challenges faced by military members, such as frequent relocations, deployments, and potential exposure to hazardous environments.

- Financial Security: Military personnel often face financial constraints due to lower salaries and unstable employment situations. USAA provides affordable and reliable insurance options to meet their financial needs.

- Exclusive Benefits: USAA offers exclusive discounts and benefits specifically tailored to military members, such as discounts for military service, deployments, and safe driving records.

- Strong Community: USAA fosters a strong sense of community among its members, providing support and resources beyond insurance services.

Accessing the Online Quote Tool

Getting a car insurance quote online with USAA is a simple process. You can access the quote tool directly from the USAA website or through their mobile app.

Accessing the Quote Tool from the USAA Website

To access the online quote tool from the USAA website, follow these steps:

- Visit the USAA website at usaa.com.

- Hover over the “Insurance” tab in the top navigation bar.

- Select “Car Insurance” from the dropdown menu.

- Click on the “Get a Quote” button.

This will take you to the online quote request form.

Accessing the Quote Tool from the USAA Mobile App

To access the online quote tool from the USAA mobile app, follow these steps:

- Open the USAA mobile app on your device.

- Tap on the “Insurance” tab.

- Select “Car Insurance” from the list of insurance options.

- Tap on the “Get a Quote” button.

This will open the online quote request form within the app.

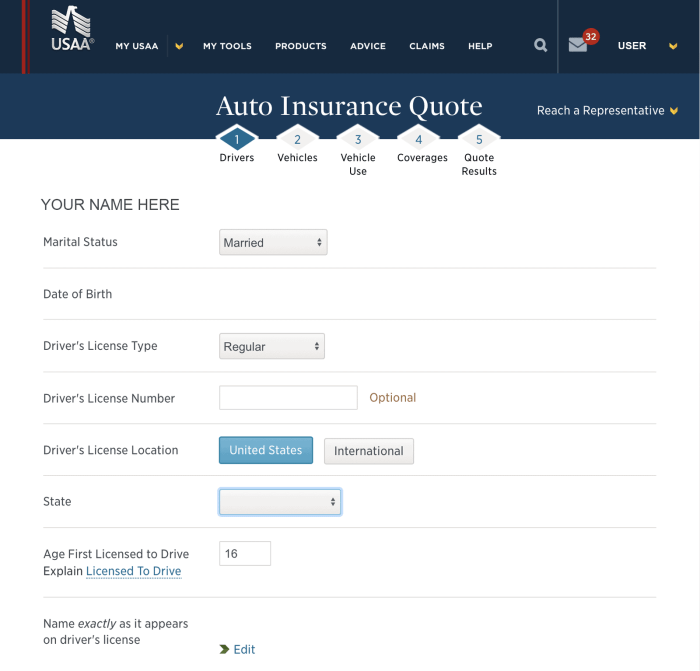

Required Information for a Quote

To get a personalized car insurance quote from USAA online, you’ll need to provide some basic information about yourself, your vehicle, and your driving history. This information helps USAA accurately assess your risk and determine the most appropriate insurance rates for you.

Vehicle Information

USAA uses your vehicle information to determine the risk associated with insuring your car.

- Year, Make, and Model: This information helps USAA understand the vehicle’s age, safety features, and overall value, all of which influence the likelihood of accidents and repair costs.

- Vehicle Identification Number (VIN): The VIN is a unique identifier for your car, allowing USAA to verify its details and confirm its authenticity.

- Mileage: Higher mileage generally indicates more wear and tear on the vehicle, which can increase the risk of accidents and repairs.

- Usage: USAA will ask about how you primarily use your car, such as for commuting, pleasure driving, or business purposes. This helps determine the frequency and type of driving you engage in, influencing the risk of accidents.

- Garage Location: The location where your car is parked overnight affects the risk of theft and vandalism, impacting your insurance rates.

Personal Information, Usaa online car insurance quote

Your personal information is crucial for USAA to understand your risk profile and offer personalized rates.

- Name and Contact Information: This information is used to identify you and communicate with you about your policy.

- Date of Birth: Your age influences your driving experience and risk assessment.

- Driving History: USAA will ask about your driving record, including any accidents, violations, or claims you’ve had in the past. This information is vital in assessing your driving behavior and risk of future accidents.

- Credit History: USAA may consider your credit history as a proxy for your overall financial responsibility. A good credit history generally suggests a lower risk of claims.

Coverage Options

USAA offers various coverage options to personalize your policy based on your needs and preferences.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause damage to another person’s property or injuries. You’ll need to choose the limits of liability coverage, which determine the maximum amount USAA will pay for damages.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who is at fault. You can choose to waive collision coverage if your car is older or has a lower value, reducing your premium.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It ensures you have financial protection in case of an accident with an uninsured or underinsured driver.

Quote Calculation and Factors

USAA calculates your car insurance quote based on a variety of factors, aiming to provide a personalized premium that reflects your individual risk profile. These factors are grouped into categories, each influencing the final quote.

Driving History

Your driving history plays a crucial role in determining your insurance premium. USAA considers factors such as:

- Driving Record: Accidents, traffic violations, and DUI convictions can significantly increase your rates. A clean driving record usually leads to lower premiums.

- Years of Driving Experience: More experienced drivers generally have lower premiums compared to new drivers, as they are statistically less likely to be involved in accidents.

- Driving Habits: USAA may offer discounts for safe driving practices, such as completing a defensive driving course or opting for telematics programs that monitor your driving behavior.

Vehicle Details

The details of your vehicle also contribute to your insurance quote. These include:

- Vehicle Make, Model, and Year: Newer and more expensive vehicles tend to have higher premiums due to their higher repair costs.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, often receive lower rates due to their reduced risk of accidents and injuries.

- Vehicle Usage: Your daily commute distance, the number of miles you drive annually, and whether you use your car for work or personal use can all impact your premium.

Location

The location where you reside and drive influences your insurance rates. Factors considered include:

- State: Insurance regulations and the frequency of accidents vary from state to state.

- Zip Code: Your specific zip code can influence your rates due to factors like population density, traffic congestion, and the prevalence of theft and vandalism.

- Climate: Areas with harsh weather conditions, such as frequent hailstorms or heavy snowfall, may have higher insurance rates due to increased risk of vehicle damage.

Discounts and Other Factors

USAA offers a variety of discounts to help you lower your premiums. These include:

- Good Student Discount: Students maintaining good academic standing may qualify for a discount.

- Multi-Policy Discount: Bundling your car insurance with other USAA insurance policies, such as homeowners or renters insurance, can lead to significant savings.

- Safe Driver Discount: Maintaining a clean driving record for a specific period can earn you a safe driver discount.

Comparing USAA Quotes with Competitors: Usaa Online Car Insurance Quote

When seeking car insurance, comparing quotes from different providers is crucial to ensure you get the best coverage at the most competitive price. USAA, known for its exceptional service and benefits for military members and their families, often stands out in terms of rates. However, it’s essential to compare USAA’s offerings with other major insurance providers to determine the most suitable option for your specific needs.

Comparison of Car Insurance Rates

To illustrate the differences in car insurance rates, let’s consider a hypothetical scenario of a 35-year-old driver with a clean driving record residing in Texas. This individual owns a 2020 Honda Civic and carries liability coverage of $100,000/$300,000, comprehensive and collision coverage with a $500 deductible, and uninsured/underinsured motorist coverage.

| Insurance Provider | Estimated Monthly Premium |

|---|---|

| USAA | $75 |

| State Farm | $85 |

| Geico | $80 |

| Progressive | $90 |

| Allstate | $95 |

While this is just an example, it highlights that USAA can be competitive in terms of pricing, often offering lower rates compared to other major insurers. However, it’s essential to remember that rates vary based on individual factors, including driving history, age, location, vehicle type, and coverage choices.

Factors Contributing to Rate Differences

Several factors influence car insurance premiums across different companies. These include:

- Risk Assessment: Insurance companies use sophisticated algorithms to assess the risk associated with each driver. Factors considered include driving history, age, location, vehicle type, and credit score. Companies with different risk assessment models may result in varying premiums.

- Operating Costs: Insurance companies have different operating costs, including administrative expenses, marketing, and claims processing. These costs are reflected in the premiums charged.

- Profit Margins: Each company has its profit targets, which influence the pricing of their insurance policies.

- Competition: The level of competition in a particular market can affect insurance rates. In highly competitive markets, insurers may offer lower premiums to attract customers.

- Discounts: Insurance companies offer various discounts, such as safe driver discounts, good student discounts, and multi-policy discounts. The availability and value of these discounts can vary across companies.

Advantages and Disadvantages of Choosing USAA

USAA offers several advantages, particularly for military members and their families:

- Exclusive Membership: USAA’s membership is restricted to active military personnel, veterans, and their families, creating a sense of community and shared values.

- Competitive Rates: USAA often offers competitive rates, especially for those with a clean driving record and a strong credit history.

- Exceptional Customer Service: USAA is consistently recognized for its outstanding customer service, known for its responsiveness and dedication to resolving issues promptly.

- Financial Stability: USAA is a financially sound company with a strong track record of stability, providing peace of mind to its members.

However, there are also some potential disadvantages to consider:

- Limited Availability: USAA’s membership eligibility is restricted to military members and their families, limiting its availability to a specific demographic.

- Fewer Options: USAA may offer a narrower range of coverage options compared to some other insurers, particularly in specialized areas such as high-value vehicles or unique driving situations.

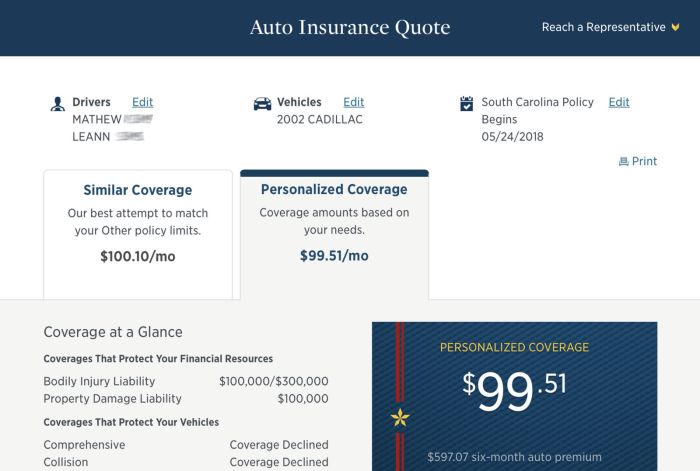

Understanding the Quote Details

Once you’ve provided all the necessary information, USAA will generate a personalized car insurance quote. This quote will Artikel the potential costs of your coverage, including premiums and various coverage options. Understanding the details of your quote is crucial for making informed decisions about your car insurance.

Coverage Options and Premiums

Your USAA car insurance quote will include a breakdown of different coverage options and their associated premiums. Coverage options refer to the types of protection you choose for your vehicle and yourself in case of accidents or other incidents. The premiums are the monthly or annual payments you make for this coverage.

- Liability Coverage: This is the most basic type of car insurance and covers damages or injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your own vehicle in a collision, regardless of who is at fault.

- Comprehensive Coverage: This protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or no insurance at all.

- Medical Payments Coverage: This covers medical expenses for you and your passengers in an accident, regardless of who is at fault.

Benefits and Limitations of Coverage Levels

The level of coverage you choose significantly impacts your premiums. Higher coverage levels generally offer more protection but come with higher costs.

- Higher Liability Limits: Increasing your liability limits provides greater financial protection in case you’re found responsible for a serious accident causing substantial damages or injuries. However, this will also increase your premiums.

- Collision and Comprehensive Coverage: These coverages are optional, and choosing to exclude them can lower your premiums. However, you’ll be responsible for paying for repairs or replacement costs in case of accidents or damages covered by these options.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but you’ll have to pay more upfront in case of a claim.

Interpreting the Quote

Your USAA car insurance quote will provide a detailed breakdown of the coverage options you’ve selected, their premiums, and any applicable discounts.

- Coverage Summary: This section Artikels the types of coverage you’ve chosen, their limits, and the corresponding premiums.

- Discounts: USAA offers various discounts based on factors like good driving history, safety features in your vehicle, and multiple policy bundling. These discounts will be reflected in your quote.

- Total Premium: This is the final amount you’ll pay for your car insurance policy, taking into account all coverage options, premiums, and applicable discounts.

Binding a USAA Car Insurance Policy

Once you’re satisfied with your USAA car insurance quote, you can proceed with binding the policy. This means formally accepting the terms of the quote and finalizing the insurance coverage. The process is straightforward and can be completed entirely online.

Completing the Online Application

After reviewing your quote, you’ll be guided through the online application process. This involves providing additional information about yourself, your vehicle, and your driving history. The application will ask for details like:

- Your contact information, including your name, address, and phone number

- Your driver’s license information

- Information about your vehicle, such as the year, make, model, and VIN

- Details about your driving history, including any accidents or violations

- Your preferred payment method

You’ll need to carefully review all the information provided and ensure its accuracy. Once you’re satisfied, you’ll be prompted to electronically sign the policy documents, indicating your agreement to the terms and conditions.

Payment Options and Policy Activation

USAA offers a variety of payment options for your car insurance premiums, including:

- Online payments: You can make payments directly through the USAA website or mobile app.

- Automatic payments: Set up automatic payments to ensure your premiums are paid on time.

- Mail-in payments: You can mail a check or money order to the address provided by USAA.

- Phone payments: You can make payments over the phone by calling USAA customer service.

Once you’ve made your first payment, your USAA car insurance policy will become active. The timeframe for policy activation can vary depending on the time of day and day of the week you bind the policy. Generally, policies are activated within 24 hours of payment.

Customer Service and Support

USAA prioritizes providing excellent customer service, especially when it comes to obtaining online car insurance quotes. They offer various channels to assist customers throughout the quoting process and beyond.

Whether you have questions about the available coverage options, need help navigating the online quote tool, or encounter any technical issues, USAA’s customer support team is readily available to provide assistance.

Available Customer Service Channels

USAA provides multiple channels to ensure you can connect with their customer support team conveniently. You can choose the method that best suits your needs and preferences.

- Online Chat: For immediate assistance, USAA offers an online chat feature directly on their website. This allows you to connect with a customer service representative in real-time and get your questions answered quickly.

- Phone Support: USAA provides dedicated phone numbers for various departments, including car insurance quotes. You can reach out to a representative by phone and receive personalized guidance throughout the quoting process.

- Email Communication: If your inquiry is not urgent, you can submit your questions or concerns through USAA’s email support system. They strive to respond to emails within a reasonable timeframe.

Resources and Tools for Quote-Related Issues

USAA offers a variety of resources and tools to help you navigate the quoting process and resolve any issues that may arise.

- FAQs: Their website features a comprehensive FAQ section that addresses common questions about online car insurance quotes, coverage options, and policy details.

- Online Help Center: USAA provides an online help center with articles, tutorials, and video guides that offer step-by-step instructions on using their online quote tool and other services.

- Contact Information: Their website provides contact information for various departments, including customer support, claims, and policy administration.

USAA Online Car Insurance Quote Benefits

Getting a car insurance quote online offers several advantages, making it a convenient and efficient way to explore your options. USAA’s online quote tool is designed to provide a quick and personalized experience, allowing you to compare rates and understand your coverage options in just a few minutes.

Convenience and Speed

The convenience of getting a car insurance quote online is undeniable. You can access USAA’s quote tool from any device with an internet connection, at any time, without needing to schedule an appointment or visit an office. This eliminates the need to travel or wait in line, saving you valuable time and effort. The entire process is streamlined and user-friendly, making it easy to gather the necessary information and receive your quote within minutes.

Personalized Pricing

USAA’s online quote tool leverages advanced algorithms and data to provide personalized pricing based on your specific circumstances. This means you’ll receive a quote tailored to your individual needs and driving history, ensuring you’re not paying for coverage you don’t require. This personalized approach can help you save money on your car insurance premiums while still having the coverage you need.

Value Proposition

USAA’s online car insurance quote tool is a valuable resource for anyone seeking a comprehensive and transparent approach to car insurance. It offers a convenient and personalized experience, allowing you to quickly compare rates, explore coverage options, and understand the value of your insurance policy. The speed, convenience, and personalized pricing provided by the online tool make it a valuable resource for anyone looking to save time, effort, and money on their car insurance.

Getting a USAA online car insurance quote is a straightforward process that allows you to compare rates, understand your coverage options, and ultimately find the best policy for your needs. Whether you’re a new driver, an experienced veteran, or simply looking for a more affordable and personalized insurance solution, USAA’s online quote tool is a valuable resource.

USAA is known for its competitive car insurance rates, especially for military members and their families. If you’re looking for the most basic coverage, you might want to explore options for cheap liability car insurance online to compare rates and find the best deal. However, keep in mind that USAA offers a wide range of coverage options and discounts, so it’s worth getting a quote from them to see how their rates stack up against other providers.