Quotes for cheap car insurance are a constant pursuit for many drivers, driven by a desire to save money while maintaining essential protection. Finding the right balance between affordability and adequate coverage can be a challenging task, especially with the ever-increasing costs of vehicle maintenance and repairs. Navigating the complexities of insurance policies, comparing quotes, and understanding the factors that influence premiums can leave drivers feeling overwhelmed. This guide aims to demystify the process of obtaining affordable car insurance, providing valuable insights and practical tips for securing the best coverage at a price that fits your budget.

Table of Contents

From understanding the key factors that determine insurance costs to exploring effective strategies for finding the most competitive quotes, this guide will equip you with the knowledge and tools needed to make informed decisions about your car insurance. We’ll also address common misconceptions about cheap car insurance and emphasize the importance of choosing a policy that offers comprehensive coverage, even at a lower price. Ultimately, our goal is to empower you to make smart choices about your car insurance and achieve peace of mind knowing you’re protected on the road.

Understanding the Need for Cheap Car Insurance

In today’s economy, where every dollar counts, finding affordable car insurance is a top priority for many drivers. The need for cheap car insurance stems from a combination of factors, including financial constraints, rising costs of living, and the desire to allocate resources wisely.

Financial Constraints and Rising Costs of Living

Financial constraints and rising costs of living play a significant role in the search for cheap car insurance. Individuals with limited incomes or those facing financial challenges often prioritize essential expenses, and car insurance premiums can represent a substantial portion of their monthly budget. The rising costs of living, including inflation and increased housing expenses, further exacerbate this need, making it crucial for drivers to find affordable insurance options.

Key Factors Influencing Car Insurance Costs

Car insurance premiums are determined by a complex interplay of various factors, each contributing to the overall cost of your policy. Understanding these factors can empower you to make informed decisions that could potentially lower your premiums.

Driving History, Quotes for cheap car insurance

Your driving history is a significant factor influencing car insurance costs. A clean driving record with no accidents or violations can earn you lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will increase your insurance rates. This is because insurers consider you a higher risk due to your past driving behavior.

For instance, a driver with a recent DUI conviction might face a 50% increase in their premium compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your car insurance premiums. Insurers assess the cost of repairs, the likelihood of theft, and the potential for injury in case of an accident. Luxury vehicles, sports cars, and high-performance models often come with higher insurance rates due to their higher repair costs and potential for higher speeds.

For example, a luxury SUV might have a significantly higher premium compared to a compact sedan due to its higher repair costs and the potential for higher speeds.

Location

The location where you live or where you primarily drive your vehicle also influences your insurance costs. Insurers consider the frequency of accidents, theft rates, and the cost of living in a particular area. Urban areas with high traffic density and higher crime rates generally have higher insurance premiums compared to rural areas with lower population density and lower crime rates.

For example, drivers residing in a densely populated city with high traffic congestion might face higher premiums compared to those living in a rural area with lower traffic density.

Age

Age is a factor that insurers consider when determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums tend to decrease.

For example, a 20-year-old driver might face significantly higher premiums compared to a 40-year-old driver with a similar driving record.

Gender

Gender is another factor that insurers consider when calculating car insurance premiums. Historically, statistics have shown that men are more likely to be involved in accidents than women. However, it’s important to note that this trend is evolving, and some insurers are now offering gender-neutral pricing.

For example, a male driver might face slightly higher premiums compared to a female driver with the same driving record and vehicle.

Credit Score

In some states, your credit score can influence your car insurance premiums. Insurers believe that individuals with good credit scores are more financially responsible and less likely to file claims.

For example, a driver with an excellent credit score might receive a discount on their insurance premiums compared to a driver with a poor credit score.

Strategies for Finding Affordable Car Insurance: Quotes For Cheap Car Insurance

Finding the right car insurance policy at an affordable price can be a daunting task, but with the right strategies, you can significantly reduce your premiums and save money. By understanding your options, comparing different providers, and taking advantage of available discounts, you can secure a policy that meets your needs without breaking the bank.

Comparing Insurance Providers and Their Offerings

It is crucial to compare different insurance providers and their offerings to find the best deal.

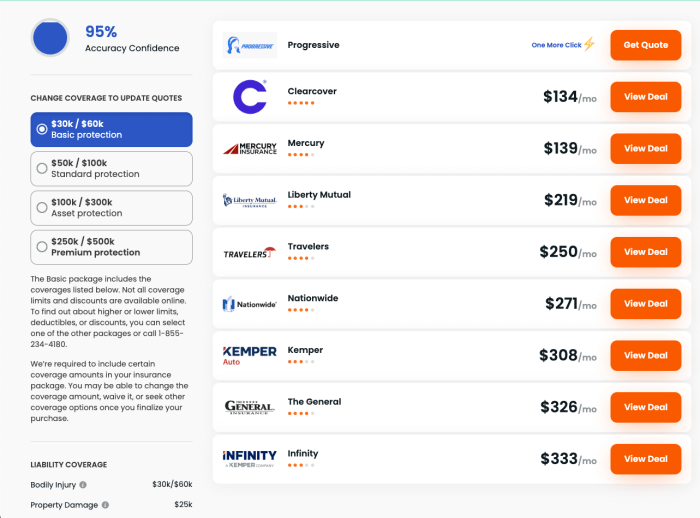

- Online Comparison Websites: Websites like Compare.com, Insurify, and Policygenius allow you to compare quotes from multiple insurance providers simultaneously. This provides a quick and convenient way to see different prices and coverage options.

- Direct Insurance Companies: These companies, such as Geico, Progressive, and State Farm, offer competitive rates and can provide personalized service. They often have user-friendly websites and mobile apps for managing your policy.

- Independent Insurance Agents: These agents work with multiple insurance companies and can help you find the best policy based on your individual needs. They can also provide valuable advice and guidance throughout the process.

Negotiating Lower Premiums and Securing Discounts

Once you have identified a few potential insurance providers, it’s time to negotiate lower premiums and explore available discounts.

- Shop Around: Get quotes from several insurance companies to compare prices and coverage options.

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Ask About Discounts: Many insurance companies offer discounts for safe driving, good credit, and other factors.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lower your premium.

- Pay Your Premium Annually: Paying your premium annually instead of monthly can often result in a lower overall cost.

Importance of Adequate Coverage

While cheap car insurance is attractive, it’s crucial to ensure your coverage is sufficient to protect you financially in case of an accident. Insufficient coverage can leave you facing significant out-of-pocket expenses, legal troubles, and even financial ruin.

Risks Associated with Insufficient Coverage

Insufficient car insurance coverage can lead to several risks, exposing you to potential financial burdens and legal consequences.

- High Out-of-Pocket Expenses: If you have inadequate coverage, you’ll be responsible for paying for damages beyond your policy limits, including medical bills, vehicle repairs, and property damage. This can quickly drain your savings and lead to financial hardship.

- Financial Ruin: In severe accidents involving injuries or extensive property damage, insufficient coverage can lead to significant financial losses, potentially forcing you into bankruptcy.

- Legal Issues: Driving without adequate insurance is illegal in most states and can result in hefty fines, license suspension, and even jail time. In addition, victims of accidents caused by uninsured or underinsured drivers may pursue legal action against you, potentially leading to substantial financial losses.

Legal Implications of Driving Without Adequate Insurance

Driving without adequate car insurance is a serious offense with significant legal consequences.

- Fines and Penalties: Depending on the state and severity of the offense, you can face fines ranging from hundreds to thousands of dollars. In some cases, repeat offenders may even face jail time.

- License Suspension: Driving without insurance is a common reason for license suspension. This can severely disrupt your daily life, making it difficult to commute, work, or even access essential services.

- Legal Liability: If you cause an accident without adequate insurance, the other party can sue you for damages, including medical bills, lost wages, and property repairs. This could lead to significant financial losses and even the seizure of your assets.

Real-Life Scenarios Where Adequate Coverage Proved Crucial

Numerous real-life scenarios illustrate the importance of adequate car insurance coverage.

- A young driver with minimal coverage was involved in a multi-car accident. While his policy covered his own damages, it wasn’t enough to cover the extensive injuries and property damage caused to others. He was forced to declare bankruptcy, losing his home and savings.

- An uninsured driver caused a serious accident, leaving the other driver with severe injuries and significant medical bills. The uninsured driver was unable to cover the costs, leaving the victim with substantial financial burdens and a lengthy legal battle.

Common Misconceptions about Cheap Car Insurance

Finding affordable car insurance is a priority for many drivers, but navigating the world of insurance policies can be confusing. There are several common misconceptions surrounding cheap car insurance that could lead to inadequate coverage and potential financial hardship in the event of an accident. It’s essential to understand these myths and prioritize comprehensive coverage while seeking affordable options.

Cheap Car Insurance Means Low Coverage

It’s a common misconception that cheap car insurance automatically equates to low coverage. While it’s true that some cheap policies might have limited coverage, it’s not always the case. Many insurance companies offer affordable policies with comprehensive coverage, including liability, collision, and comprehensive coverage. The key is to compare policies carefully and understand the specific coverage offered by each provider. For example, a policy might have a lower deductible for collision coverage, which can significantly impact your out-of-pocket expenses in the event of an accident.

Cheap Car Insurance is Always the Best Option

Choosing the cheapest car insurance policy isn’t always the best strategy. While affordability is important, it’s crucial to consider the level of coverage you need and the potential risks associated with your driving habits and vehicle type. For instance, if you drive a high-value car or frequently drive in high-traffic areas, opting for a more comprehensive policy with higher coverage limits might be a better choice in the long run, even if it costs slightly more. In the event of an accident, inadequate coverage could leave you with significant out-of-pocket expenses, potentially exceeding the savings you achieved by choosing a cheaper policy.

Cheap Car Insurance is Risky

Some people believe that cheap car insurance is inherently risky, leading to unreliable service or difficulty filing claims. While some companies might have a reputation for poor customer service or claim processing, this is not always the case with cheap insurance policies. Reputable insurance companies offer affordable options with excellent customer service and efficient claim processing. It’s important to research the company’s reputation and read reviews from other customers before making a decision. You can also check the company’s financial stability and claim settlement ratios to ensure they are reliable and financially sound.

You Can Always Get Cheap Car Insurance

Not everyone qualifies for cheap car insurance. Factors such as driving history, age, location, and vehicle type can significantly impact your insurance premiums. Drivers with a history of accidents or violations, for example, are likely to pay higher premiums than those with clean driving records. Similarly, drivers in high-risk areas or those driving high-value vehicles might face higher premiums. It’s important to be realistic about your insurance needs and expectations, and to understand that finding the cheapest policy might not always be feasible.

Cheap Car Insurance is Easy to Find

Finding cheap car insurance can be time-consuming and require effort. It involves comparing quotes from multiple insurance companies, understanding the coverage options available, and negotiating premiums. Don’t be fooled by advertisements or promises of instant quotes; take the time to research and compare policies thoroughly before making a decision. Consider using online comparison tools or contacting insurance brokers to help you find the best deal.

Tips for Safe Driving and Cost Savings

Safe driving habits are not only crucial for your personal safety but also have a significant impact on your car insurance premiums. By adopting defensive driving techniques and maintaining your vehicle, you can significantly reduce your risk of accidents and, in turn, enjoy lower insurance costs.

Defensive Driving Courses

Defensive driving courses are designed to equip drivers with the knowledge and skills to anticipate potential hazards and react effectively in various driving situations. These courses typically cover topics such as:

- Recognizing and avoiding common driving distractions

- Understanding the principles of safe following distances

- Developing effective braking and maneuvering techniques

- Managing aggressive drivers and road rage

Completing a defensive driving course can demonstrate your commitment to safe driving practices and often results in a discount on your car insurance premiums.

Vehicle Maintenance

Regular vehicle maintenance is essential for ensuring your car’s safety and reliability, which directly contributes to your driving safety and potentially lower insurance costs.

- Regular oil changes and filter replacements are crucial for engine performance and longevity.

- Maintaining proper tire pressure and tread depth improves handling and braking efficiency.

- Checking and replacing worn-out brake pads and rotors can prevent accidents and ensure optimal braking performance.

- Ensuring proper functioning of headlights, taillights, and turn signals enhances visibility and safety on the road.

By addressing these maintenance needs, you minimize the risk of breakdowns or accidents, leading to potential cost savings on insurance premiums.

Online Resources and Tools for Comparison

Finding the right car insurance policy can be a daunting task, but thankfully, several online resources and tools are available to simplify the process and help you find the best deals. These platforms allow you to compare quotes from various insurance companies side-by-side, enabling you to make an informed decision based on your specific needs and budget.

Comparison Platforms and Their Features

Several reputable online platforms specialize in comparing car insurance quotes. These platforms are designed to streamline the process, making it easier for you to find the best rates and coverage options.

- Compare.com: This platform allows you to compare quotes from multiple insurance companies, including well-known brands and regional insurers. It also offers features like personalized recommendations and policy insights, helping you understand the different coverage options available.

- Insurify: Insurify is another popular platform that aggregates quotes from various insurers. It emphasizes its user-friendly interface and quick comparison process. The platform also provides information on insurance company ratings and customer reviews, helping you assess the reputation of different providers.

- Policygenius: Policygenius is a comprehensive platform that goes beyond just comparing car insurance quotes. It offers tools for comparing other insurance products, including life insurance, renters insurance, and homeowners insurance. The platform also provides personalized advice and guidance from licensed insurance agents.

- The Zebra: The Zebra is a platform that focuses on providing transparent and unbiased comparisons of car insurance quotes. It allows you to filter quotes based on specific criteria, such as coverage options, deductibles, and discounts. The platform also offers tools for managing your insurance policies.

Using Comparison Tools Effectively

Using online comparison tools effectively is crucial to finding the best car insurance deals. Here are some tips for maximizing the benefits of these platforms:

- Be accurate with your information: Provide accurate details about your vehicle, driving history, and personal information. Inaccurate information can lead to inaccurate quotes and may result in higher premiums later.

- Compare multiple quotes: Don’t settle for the first quote you receive. Compare quotes from different insurers to ensure you’re getting the best possible rate.

- Consider coverage options: Don’t just focus on the cheapest quote. Compare the coverage options offered by different insurers and choose a policy that provides adequate protection for your needs and budget.

- Look for discounts: Many insurers offer discounts for safe driving, good grades, multiple policies, and other factors. Make sure to ask about any available discounts and factor them into your decision.

The Role of Customer Service and Claims Processing

Finding cheap car insurance is only one part of the equation. You also need to consider the quality of customer service and the efficiency of claims processing. A company that may offer the lowest rates could end up costing you more in the long run if they make it difficult to file a claim or provide support when you need it.

Responsive customer service and efficient claims handling are crucial for a positive insurance experience. When you need help, you want to be able to reach a representative quickly and easily. You also want to be confident that your claims will be processed fairly and promptly. This is especially important in the event of an accident, when you are already dealing with stress and potential financial hardship.

Positive and Negative Customer Service Experiences

Here are some examples of how good and bad customer service can impact your insurance experience:

- Positive Example: Imagine you get into a minor fender bender. You call your insurance company and are immediately connected to a friendly and helpful representative who guides you through the claims process. They explain your coverage options and help you file a claim online. Within a few days, you receive an email with a status update and a check for the repairs. You are impressed by the speed and efficiency of the process and feel confident that your insurance company is there for you.

- Negative Example: You are involved in a more serious accident. You call your insurance company but are put on hold for an extended period. When you finally reach a representative, they are unhelpful and dismissive. They tell you that you need to wait for a claims adjuster to come to your location, but they are not available for several days. You are frustrated by the lack of support and feel like you are on your own.

Impact of Claims History on Future Premiums

It is important to understand that your claims history can significantly impact your future premiums. Insurance companies use a system called a “loss ratio” to calculate their risk. A loss ratio is the ratio of claims paid out to premiums collected. If an insurance company has a high loss ratio, it means they are paying out more in claims than they are collecting in premiums. To compensate for this, they may increase premiums for all policyholders. This is why it is important to drive safely and avoid making claims unless absolutely necessary. Even if you are at fault for an accident, it is often more cost-effective to pay for repairs yourself if the damage is minor.

Maintaining Coverage and Making Adjustments

Staying informed about your car insurance policy and making necessary adjustments can significantly impact your overall cost and coverage. It’s crucial to understand the nuances of your policy and make informed decisions based on your individual needs and circumstances.

Staying Informed about Policy Renewals

It’s essential to be proactive about your insurance policy renewals. This includes understanding your renewal date, reviewing the terms and conditions of your new policy, and comparing it to your previous one. You should also be aware of any changes in premiums, coverage, or deductibles.

- Set reminders: Utilize calendar reminders, email alerts, or mobile app notifications to ensure you don’t miss your renewal date. This will give you ample time to review your policy and make any necessary adjustments.

- Compare quotes: Before renewing, consider comparing quotes from different insurance providers. This will help you determine if your current insurer offers the best rates and coverage options.

- Review policy changes: Carefully read through the renewal documents to understand any changes in coverage, premiums, or deductibles. Don’t hesitate to contact your insurance provider if you have any questions.

Adjusting Coverage Based on Life Changes

Life changes often require adjustments to your car insurance policy. For example, if you get married, have children, or move to a new location, your insurance needs may change.

- Marriage: If you get married, your spouse may be added to your policy, potentially affecting your premiums.

- Children: Having children may require additional coverage, such as increasing your liability limits or adding coverage for new drivers.

- Moving: Relocating to a new area could influence your premiums, as insurance rates vary based on location.

Making Modifications to Existing Policies

Making modifications to your existing insurance policy can be a simple process. It often involves contacting your insurance provider, explaining the desired changes, and providing any necessary documentation.

- Increasing or decreasing coverage: You can adjust your coverage limits based on your needs. For example, if you purchase a new car, you may need to increase your collision and comprehensive coverage.

- Changing deductibles: Modifying your deductible can affect your premiums. A higher deductible typically leads to lower premiums, while a lower deductible results in higher premiums.

- Adding or removing drivers: If you add a new driver to your policy, such as a teenager or a spouse, your premiums may increase. Removing a driver, such as a child who moves out, can potentially lower your premiums.

Finding cheap car insurance is a balancing act between affordability and adequate coverage. By understanding the key factors that influence premiums, utilizing available resources, and making informed decisions, drivers can secure the best protection at a price that works for them. Remember to carefully review policy documents, choose a reputable insurance provider with excellent customer service, and maintain your coverage by making necessary adjustments as your needs change. With the right approach, you can confidently navigate the world of car insurance and enjoy the peace of mind that comes with knowing you’re protected on the road.

Finding cheap car insurance quotes can be a real hassle, but it doesn’t have to be. You can easily get free car insurance quotes online by visiting websites like get free car insurance quotes online. This way, you can compare quotes from different insurance companies and find the best deal that fits your budget and needs.