My Humana Medicare Advantage represents a significant step towards securing your health and well-being. This guide delves into the intricate world of Humana Medicare Advantage plans, offering a comprehensive overview of their features, benefits, and how they can cater to your specific needs.

Table of Contents

Whether you’re new to Medicare or seeking to explore alternative options, understanding Humana Medicare Advantage is crucial. This guide will empower you with the knowledge to make informed decisions about your healthcare coverage, ensuring you have the right plan to navigate the complexities of the healthcare system.

Humana Medicare Advantage

Humana Medicare Advantage plans are a popular alternative to Original Medicare. They are offered by private insurance companies, like Humana, and provide comprehensive coverage for your health care needs. These plans work by combining the benefits of Original Medicare Parts A and B with additional features, such as prescription drug coverage and other benefits, such as vision, dental, and hearing.

Humana Medicare Advantage Plans: Key Features and Benefits

Humana Medicare Advantage plans offer a wide range of features and benefits that can help you save money and improve your health.

- Prescription Drug Coverage: Humana Medicare Advantage plans typically include prescription drug coverage, known as Part D, which can help you save on the cost of your medications.

- Additional Benefits: Many Humana Medicare Advantage plans offer additional benefits beyond what is covered by Original Medicare, such as vision, dental, and hearing coverage.

- Lower Out-of-Pocket Costs: Humana Medicare Advantage plans often have lower out-of-pocket costs than Original Medicare, such as lower deductibles and copayments.

- Health and Wellness Programs: Humana Medicare Advantage plans may offer health and wellness programs, such as disease management programs, fitness classes, and health screenings, to help you stay healthy.

- Care Coordination: Humana Medicare Advantage plans may have care coordination services that can help you manage your health care and connect with the right providers.

Humana Medicare Advantage vs. Original Medicare

Humana Medicare Advantage plans differ from Original Medicare in several key ways:

- Coverage: Humana Medicare Advantage plans combine the coverage of Original Medicare Parts A and B with additional benefits, such as prescription drug coverage. Original Medicare requires you to purchase separate coverage for prescription drugs (Part D).

- Cost: Humana Medicare Advantage plans typically have lower out-of-pocket costs than Original Medicare, but they may have higher monthly premiums.

- Network: Humana Medicare Advantage plans have a network of providers you must use, while Original Medicare allows you to choose any provider who accepts Medicare.

Costs and Premiums

Understanding the costs associated with a Humana Medicare Advantage plan is crucial for making an informed decision. Premiums, deductibles, copayments, and coinsurance all play a role in determining your overall out-of-pocket expenses.

Premium Calculation

Humana Medicare Advantage plan premiums are calculated based on several factors, including:

* Age: Older individuals generally pay higher premiums due to higher healthcare utilization.

* Location: Premiums can vary depending on the cost of living and healthcare costs in your area.

* Health Status: Individuals with pre-existing conditions may pay higher premiums.

* Plan Benefits: Plans with more comprehensive coverage and benefits typically have higher premiums.

* Plan Network: Plans with wider networks of providers may have higher premiums.

The specific formula used to calculate premiums is proprietary to Humana and may vary depending on the plan.

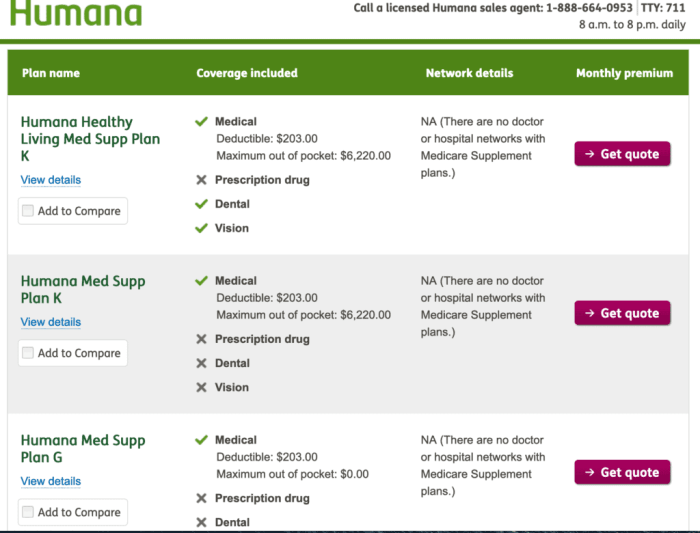

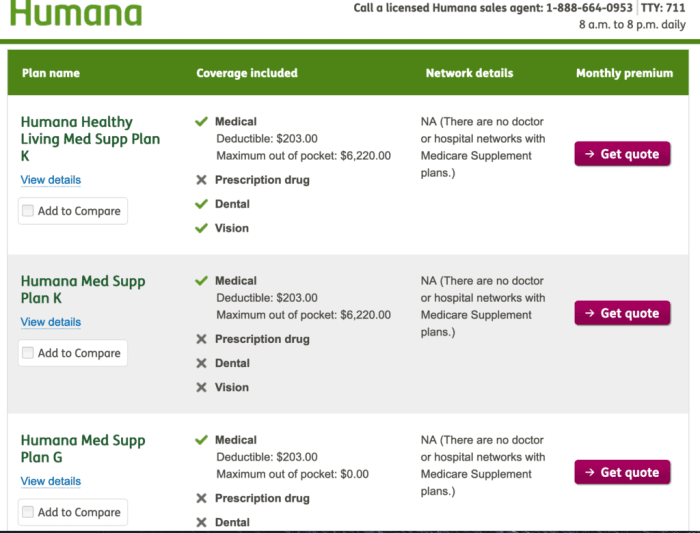

Comparison of Costs

Humana offers a variety of Medicare Advantage plans with different costs and benefits. To compare the costs of different plans, you can use the following resources:

* Humana’s Website: Humana provides a comprehensive plan finder tool on its website that allows you to compare plans based on cost, benefits, and provider network.

* Medicare.gov: The Medicare website also provides information on Medicare Advantage plans, including premiums, deductibles, and copayments.

* A Licensed Insurance Agent: A licensed insurance agent can help you understand the different plan options and find the best plan for your needs and budget.

Cost-Sharing Requirements

Medicare Advantage plans typically have cost-sharing requirements, such as deductibles, copayments, and coinsurance. These requirements help to manage costs and ensure that beneficiaries share in the responsibility for their healthcare.

* Deductible: This is the amount you must pay out-of-pocket before your plan begins to cover costs.

* Copayment: This is a fixed amount you pay for certain services, such as doctor visits or prescription drugs.

* Coinsurance: This is a percentage of the cost of a service that you pay.

It’s important to note that cost-sharing requirements can vary significantly between different Humana Medicare Advantage plans.

Health and Wellness Programs: My Humana Medicare Advantage

Humana Medicare Advantage plans go beyond just covering medical costs. They offer a range of health and wellness programs designed to help you stay healthy, manage chronic conditions, and live a better life.

These programs can benefit members in many ways. They can help you prevent illness, manage existing conditions, improve your overall health, and potentially save you money on healthcare costs.

Disease Management Programs

Disease management programs are specifically designed to help you manage chronic conditions like diabetes, heart disease, and asthma. These programs can provide you with:

* Personalized support and education: You’ll receive guidance and information about your condition, including how to manage it effectively.

* Regular monitoring and check-ups: These programs often involve regular contact with healthcare professionals to monitor your condition and ensure you’re on track.

* Medication management: You’ll receive support to ensure you’re taking your medications correctly and safely.

Fitness Incentives, My humana medicare advantage

Many Humana Medicare Advantage plans offer fitness incentives to encourage members to stay active. These incentives can include:

* Rewards for participating in fitness activities: You might earn points or discounts for participating in activities like walking, swimming, or joining a gym.

* Access to fitness programs and resources: These programs might offer discounts on gym memberships, access to online fitness programs, or other resources to help you stay active.

* Personalized fitness plans: You might receive a personalized fitness plan tailored to your needs and goals.

Health Screenings

Humana Medicare Advantage plans often cover preventive health screenings that can help detect health problems early on. These screenings can include:

* Annual wellness visits: These visits are designed to help you stay healthy and prevent illness.

* Cancer screenings: These screenings can help detect cancer at an early stage, when it’s often easier to treat.

* Other screenings: Humana may also cover screenings for conditions like diabetes, high blood pressure, and cholesterol.

Medicare Advantage Plan Changes

It’s important to understand that Humana Medicare Advantage plans can change from year to year. These changes can affect your coverage, costs, and even the doctors and hospitals in your network.

Annual Open Enrollment Period

Each year, from October 15th to December 7th, Medicare Advantage members have the opportunity to review their current plan and consider switching to a different Humana Medicare Advantage plan or returning to Original Medicare. This period allows you to make changes to your coverage based on your evolving needs and preferences.

During open enrollment, you can:

- Switch to a different Humana Medicare Advantage plan that better suits your needs, such as one with lower premiums or different benefits.

- Return to Original Medicare, giving you more flexibility in choosing doctors and hospitals but potentially higher out-of-pocket costs.

- Enroll in a new Medicare Advantage plan if you’re currently not enrolled in one.

Staying Informed About Plan Updates

Humana provides various resources to keep you informed about plan changes and updates:

- Annual Notice of Change (ANOC): Humana will send you an ANOC each year detailing any changes to your plan’s coverage, costs, and benefits for the upcoming year. It’s crucial to review this document carefully to understand the changes and make informed decisions about your coverage.

- Humana’s website: You can find the latest information about your plan, including details on coverage, costs, and provider networks, on Humana’s website.

- Humana’s customer service: You can contact Humana’s customer service department for assistance with any questions you may have about plan changes or updates.

Resources and Additional Information

We understand that you may have questions or need additional information about Humana Medicare Advantage plans. We’ve compiled a list of resources to help you find the information you need.

Official Websites

These websites provide comprehensive information about Medicare Advantage plans, eligibility, and other relevant details:

- Humana Website: [https://www.humana.com/](https://www.humana.com/) – Explore Humana’s website for plan details, benefits, and contact information.

- Medicare.gov: [https://www.medicare.gov/](https://www.medicare.gov/) – Access the official Medicare website for general information, plan comparisons, and enrollment assistance.

Helpful Organizations

Connect with these organizations for support and guidance on Medicare Advantage plans:

- Medicare Rights Center: [https://www.medicarerights.org/](https://www.medicarerights.org/) – Provides free counseling and advocacy services to Medicare beneficiaries.

- Senior Citizens League: [https://www.scl.org/](https://www.scl.org/) – Advocates for the interests of older Americans, including Medicare issues.

Downloadable Resources

Access valuable information in downloadable formats:

- Humana Medicare Advantage Plan Brochures: [Link to downloadable brochures](Link to downloadable brochures) – Find detailed information about specific Humana plans.

- Medicare Advantage Fact Sheets: [Link to downloadable fact sheets](Link to downloadable fact sheets) – Get concise summaries of Medicare Advantage plan features and benefits.

Contacting Humana

Reach out to Humana for personalized assistance:

- Phone Number: [Insert Humana’s phone number] – Call Humana’s customer service line for immediate support.

- Email Address: [Insert Humana’s email address] – Send an email for inquiries or to request information.

- Live Chat: [Link to Humana’s live chat](Link to Humana’s live chat) – Engage in real-time conversations with Humana representatives.

Additional Support

Explore these resources for further assistance:

- State Health Insurance Assistance Programs (SHIP): [Link to SHIP website](Link to SHIP website) – Get free counseling and support from certified SHIP counselors.

- Medicare Advantage Plan Finder: [Link to Medicare Plan Finder](Link to Medicare Plan Finder) – Use this tool to compare Medicare Advantage plans in your area.

Navigating the healthcare landscape can be challenging, but understanding your options is key to making informed choices. By delving into the intricacies of Humana Medicare Advantage plans, you gain a valuable tool for securing your health and well-being. This guide has provided a foundation for understanding eligibility, coverage, costs, and other essential aspects. As you embark on your journey toward optimal healthcare, remember that Humana Medicare Advantage offers a comprehensive and customizable approach to meet your individual needs.

My Humana Medicare Advantage plan has been a lifesaver, providing me with comprehensive coverage and peace of mind. I’m always impressed by Humana’s commitment to quality healthcare, which is evident in their humana business practices. Their dedication to customer satisfaction shines through in their plan options and the responsive support I receive. Overall, I’m very happy with my Humana Medicare Advantage experience.