Humana whole life insurance offers a lifetime of coverage, providing financial security for your loved ones and building cash value that can be accessed for various financial needs. This type of insurance policy provides a guaranteed death benefit, meaning your beneficiaries will receive a specific sum of money upon your passing, regardless of when that occurs. Additionally, Humana whole life insurance accumulates cash value, which grows over time and can be borrowed against or withdrawn for financial emergencies, retirement planning, or other purposes. This comprehensive guide will delve into the features, benefits, and considerations of Humana whole life insurance, helping you understand if it’s the right choice for your unique circumstances.

Table of Contents

Humana whole life insurance stands out from other life insurance options like term life insurance, which provides coverage for a specific period. While term life insurance is generally more affordable, it doesn’t offer cash value accumulation. Understanding the differences between these types of policies is crucial when deciding on the best life insurance solution for your individual needs and financial goals.

Policy Structure and Coverage: Humana Whole Life Insurance

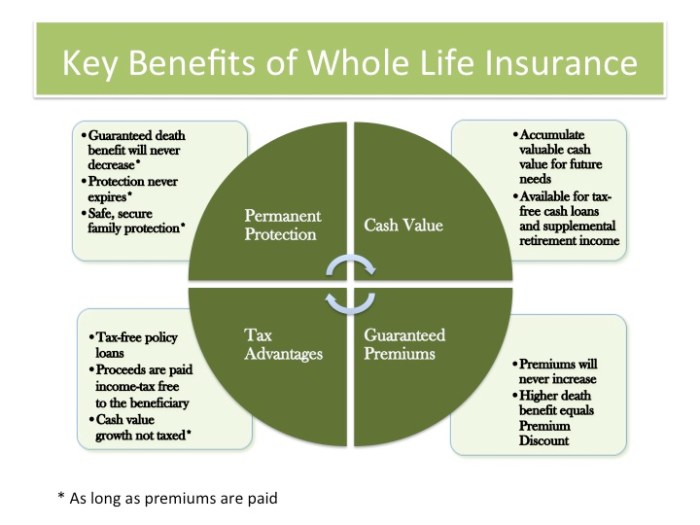

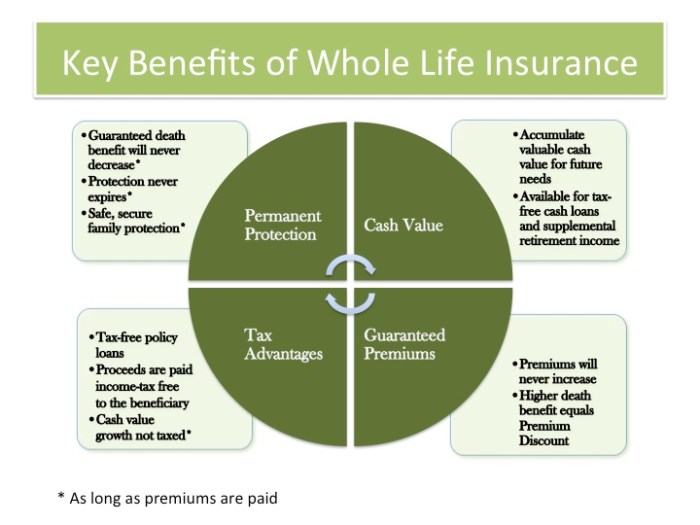

Humana whole life insurance policies are designed to provide lifelong coverage and accumulate cash value. This comprehensive policy combines death benefit protection with a savings component, offering financial security for you and your loved ones.

Death Benefit

The death benefit is the core element of any whole life insurance policy. It is the lump sum payment that your beneficiaries will receive upon your death. This payment can be used to cover final expenses, outstanding debts, or provide financial support to your loved ones. The death benefit amount is fixed at the time you purchase the policy and remains constant throughout the policy’s duration.

Cash Value

A significant feature of Humana whole life insurance is its cash value component. This is a savings component that grows over time through the accumulation of premiums and investment earnings. You can access this cash value through policy loans or withdrawals, subject to specific terms and conditions.

Premiums

Premiums are the regular payments you make to maintain your whole life insurance policy. These premiums are calculated based on several factors, including your age, health, and the amount of coverage you choose. Premiums are typically fixed for the duration of the policy, ensuring predictable costs for your financial planning.

Premium Calculation

The calculation of premiums for whole life insurance involves complex actuarial calculations that consider various factors:

- Your age and health: Younger and healthier individuals typically pay lower premiums compared to older or less healthy individuals.

- Death benefit amount: Higher death benefits result in higher premiums, as the insurance company assumes greater financial risk.

- Interest rates: Premiums are also influenced by prevailing interest rates, which impact the growth of the cash value component.

- Administrative expenses: The insurance company’s operating costs, including administrative expenses, are factored into premium calculations.

Premium Fluctuation

While premiums are generally fixed for the life of the policy, they can fluctuate under certain circumstances:

- Changes in interest rates: If interest rates significantly decline, premiums may be adjusted to ensure the policy remains financially sound.

- Policy changes: If you make changes to your policy, such as increasing the death benefit or adding riders, your premiums may be affected.

Coverage Options, Humana whole life insurance

Humana whole life insurance offers a range of coverage options to tailor your policy to your specific needs:

- Accidental Death Benefit: This rider provides an additional death benefit payment if your death is caused by an accident.

- Living Benefits: Some Humana whole life policies offer living benefits, allowing you to access a portion of your death benefit while you are still alive for specific health-related expenses.

- Waiver of Premium: This rider waives your premium payments if you become disabled and unable to work.

- Guaranteed Insurability: This rider allows you to purchase additional coverage at certain intervals without requiring a medical exam.

Choosing the right life insurance policy is a significant financial decision. Humana whole life insurance offers a combination of lifetime coverage, cash value growth, and potential tax advantages, making it a compelling option for individuals seeking a comprehensive and long-term financial safety net. However, it’s essential to weigh the pros and cons, consider your financial situation, and compare various life insurance options before making a final decision. Consulting with a financial advisor can provide valuable insights and personalized guidance to help you make the most informed choice for your unique needs and circumstances.

Humana Whole Life Insurance offers a lifetime of coverage, ensuring financial security for your loved ones. While it’s a great option for long-term financial planning, you might also want to consider humana group health insurance for your employees. This can provide comprehensive health coverage and help attract and retain top talent, which can further strengthen your financial position.