Humana supplement plans offer a unique way to enhance your health insurance coverage, providing additional financial protection against out-of-pocket medical expenses. These plans, often referred to as Medigap plans, can be a valuable asset for individuals seeking peace of mind and greater financial stability when facing unexpected medical costs.

Table of Contents

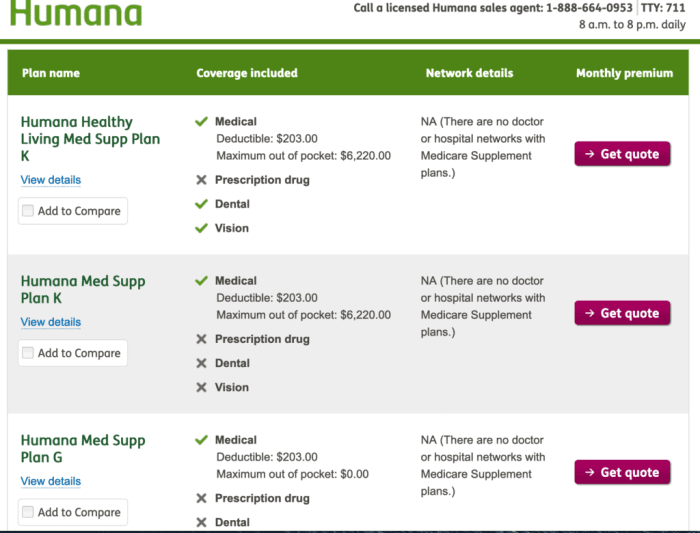

Humana offers a variety of supplement plans designed to meet different needs and budgets. Whether you’re a Medicare beneficiary looking to reduce your out-of-pocket expenses or an individual seeking supplemental coverage for specific health concerns, Humana has plans that can provide you with the protection you need.

Humana Supplement Plans for Individuals Outside Medicare

Humana offers a range of supplemental insurance plans designed to help individuals who are not eligible for Medicare cover their healthcare costs. These plans are a great option for individuals who want to protect themselves from high medical bills and have peace of mind knowing they have additional coverage.

Types of Coverage Offered by Humana Supplement Plans for Non-Medicare Individuals

Humana offers a variety of supplement plans for individuals outside Medicare, each designed to address specific healthcare needs. These plans can help you cover expenses that your primary health insurance might not, providing comprehensive protection. Here are some common types of coverage offered by Humana:

- Critical Illness Insurance: This type of insurance provides a lump-sum payment if you are diagnosed with a serious illness, such as cancer, heart attack, or stroke. The payment can help you cover medical expenses, lost wages, and other costs associated with your illness.

- Accident Insurance: Accident insurance provides coverage for medical expenses and lost income resulting from accidents. It can help cover costs associated with hospital stays, surgeries, and rehabilitation.

- Dental Insurance: Dental insurance helps cover the cost of dental care, such as cleanings, fillings, and extractions. It can help you save money on dental expenses and maintain good oral health.

- Vision Insurance: Vision insurance helps cover the cost of eye exams, eyeglasses, and contact lenses. It can help you save money on vision care and ensure you have access to the eye care you need.

Comparison of Humana Supplement Plans for Non-Medicare Individuals

The following table compares Humana supplement plans for non-Medicare individuals based on their coverage, premiums, and eligibility criteria:

| Plan Name | Coverage | Premium | Eligibility Criteria |

|---|---|---|---|

| Humana Critical Illness Insurance | Covers medical expenses, lost wages, and other costs associated with a critical illness. | Varies based on age, health, and coverage amount. | Individuals between the ages of 18 and 70. |

| Humana Accident Insurance | Covers medical expenses and lost income resulting from accidents. | Varies based on age, health, and coverage amount. | Individuals between the ages of 18 and 70. |

| Humana Dental Insurance | Covers the cost of dental care, such as cleanings, fillings, and extractions. | Varies based on age, location, and coverage level. | Individuals of all ages. |

| Humana Vision Insurance | Covers the cost of eye exams, eyeglasses, and contact lenses. | Varies based on age, location, and coverage level. | Individuals of all ages. |

Choosing the Right Humana Supplement Plan

Choosing the right Humana supplement plan can significantly impact your healthcare costs and coverage. It’s essential to consider various factors to find a plan that meets your individual needs and budget.

Factors to Consider

When selecting a Humana supplement plan, several key factors should be considered. These include your individual health needs, budget, and coverage requirements.

- Individual Health Needs: Your current health status and any pre-existing conditions play a crucial role in choosing a supplement plan. If you have specific health concerns, you may require a plan with broader coverage to ensure adequate protection.

- Budget: Supplement plans come with varying premiums and deductibles. It’s essential to determine your budget and select a plan that fits your financial capacity. Remember that higher premiums generally offer more comprehensive coverage.

- Coverage Requirements: Carefully review the coverage details of each plan to understand the specific benefits it offers. Consider factors like the plan’s coverage for hospital stays, doctor visits, prescription drugs, and other essential healthcare services.

Comparing and Choosing the Best Plan

To compare and choose the best Humana supplement plan for your needs, follow these steps:

- Identify Your Needs: Determine your specific healthcare needs and coverage requirements. Consider your current health status, potential future healthcare needs, and budget.

- Explore Humana’s Online Resources: Utilize Humana’s website and online tools to explore plan options and compare coverage details. These resources provide comprehensive information on premiums, deductibles, benefits, and other essential details.

- Contact Humana for Assistance: If you need further guidance or have specific questions, reach out to Humana’s customer service team for assistance. They can provide personalized recommendations and help you understand the nuances of different plans.

- Review and Compare: Carefully review the coverage details and costs of different plans. Use Humana’s comparison tools to side-by-side evaluate options and identify the best fit for your needs and budget.

- Make an Informed Decision: Based on your thorough research and understanding of the different plans, choose the Humana supplement plan that provides the best value and coverage for your individual circumstances.

Utilizing Humana’s Online Resources

Humana offers a wide range of online resources to help you explore and compare supplement plan options. These resources include:

- Plan Finder: Humana’s Plan Finder tool allows you to search for plans based on your zip code, age, and other criteria. This tool provides detailed information on premiums, deductibles, and coverage benefits.

- Plan Comparison Tool: The Plan Comparison Tool allows you to side-by-side compare different plans, highlighting key differences in coverage and costs. This tool helps you make informed decisions based on your specific needs.

- Online Chat and FAQs: Humana provides online chat support and frequently asked questions (FAQs) to address common inquiries and provide quick answers to your questions.

Humana Supplement Plan Enrollment and Administration

Enrolling in a Humana supplement plan and managing it effectively is crucial for ensuring your health insurance coverage and maximizing your benefits. This section will guide you through the enrollment process, including application requirements and timelines, and delve into the administrative procedures involved in managing your Humana supplement plan.

Enrollment Process, Humana supplement plans

The enrollment process for Humana supplement plans is straightforward. You’ll need to provide personal information and details about your health status.

- Application Requirements:

- Personal Information: Name, address, date of birth, Social Security number, contact details.

- Health Information: Medical history, current medications, pre-existing conditions.

- Financial Information: Income details, bank account information (for premium payments).

- Timeline:

- Application Submission: You can apply online, by phone, or through a Humana agent.

- Review and Approval: Humana will review your application and make a decision within a few business days.

- Coverage Effective Date: Once approved, your coverage will typically become effective on the first of the month following your application.

Administrative Procedures

Managing your Humana supplement plan involves several administrative procedures, including premium payments, claim filing, and accessing customer support.

- Premium Payments:

- Payment Options: You can pay your premiums online, by mail, or by phone.

- Payment Due Date: Premiums are typically due on the first of each month.

- Late Payment Penalties: Late payments may incur penalties, so it’s essential to pay on time.

- Claim Filing:

- Filing Methods: You can file claims online, by mail, or by phone.

- Required Information: When filing a claim, you’ll need to provide details about your medical services, including dates of service, provider information, and diagnosis.

- Claim Processing: Humana will review your claim and process it within a specified timeframe.

- Customer Support:

- Contact Information: You can reach Humana customer support by phone, email, or online chat.

- Support Services: Humana offers support for various inquiries, including plan details, coverage questions, claim assistance, and general information.

Summary of Enrollment and Administrative Procedures

| Procedure | Details |

|---|---|

| Enrollment Application | Requires personal, health, and financial information. |

| Application Review and Approval | Humana typically reviews applications within a few business days. |

| Coverage Effective Date | Coverage usually starts on the first of the month following application approval. |

| Premium Payments | Payments can be made online, by mail, or by phone. |

| Claim Filing | Claims can be filed online, by mail, or by phone. |

| Customer Support | Contact Humana by phone, email, or online chat for assistance. |

Humana Supplement Plan Costs and Premiums

Understanding the cost of Humana supplement plans is crucial for making informed decisions. Several factors influence the premium you’ll pay, and knowing these factors can help you find the most affordable option.

Factors Influencing Humana Supplement Plan Premiums

The premium you pay for a Humana supplement plan depends on several factors. Understanding these factors can help you make informed decisions about your coverage and budget.

- Age: As you age, your risk of health issues increases, leading to higher premiums. Younger individuals generally pay lower premiums compared to older individuals.

- Health Status: Individuals with pre-existing health conditions may face higher premiums. Humana assesses your health history to determine your risk profile, which influences your premium.

- Coverage Level: The level of coverage you choose impacts your premium. Plans with higher coverage levels, such as those covering a greater percentage of your medical expenses, typically come with higher premiums.

- Location: Premiums can vary depending on your geographic location. Factors like the cost of healthcare in your area can influence the price of supplement plans.

- Tobacco Use: Humana typically charges higher premiums to smokers compared to non-smokers. This reflects the higher health risks associated with smoking.

Examples of Estimated Premium Costs

Here are some examples of estimated premium costs for different Humana supplement plans, based on various demographics. These are estimates only, and actual premiums may vary.

| Age | Health Status | Coverage Level | Estimated Monthly Premium |

|---|---|---|---|

| 40 | Healthy | Basic | $150 |

| 65 | Pre-existing Condition (Diabetes) | Comprehensive | $350 |

| 70 | Healthy | High Deductible | $200 |

Tips to Reduce or Manage Humana Supplement Plan Costs

While you can’t control all factors affecting your premium, there are ways to potentially reduce or manage your costs.

- Shop Around: Compare quotes from different insurance providers, including Humana, to find the most competitive rates.

- Consider a Higher Deductible: Opting for a higher deductible can often result in lower premiums. However, you’ll need to pay more out of pocket before your insurance kicks in.

- Explore Bundling Options: Humana may offer discounts if you bundle your supplement plan with other insurance products, such as Medicare Advantage.

- Maintain a Healthy Lifestyle: Maintaining a healthy lifestyle can help lower your risk of health issues, potentially leading to lower premiums in the long run.

Humana Supplement Plan Coverage and Exclusions

Humana supplement plans, also known as Medigap plans, are designed to help cover the out-of-pocket costs associated with Original Medicare. These plans offer additional coverage for services that Original Medicare may not fully cover, such as deductibles, copayments, and coinsurance. However, it’s important to understand the specific coverage and exclusions of each Humana supplement plan to ensure it meets your individual needs.

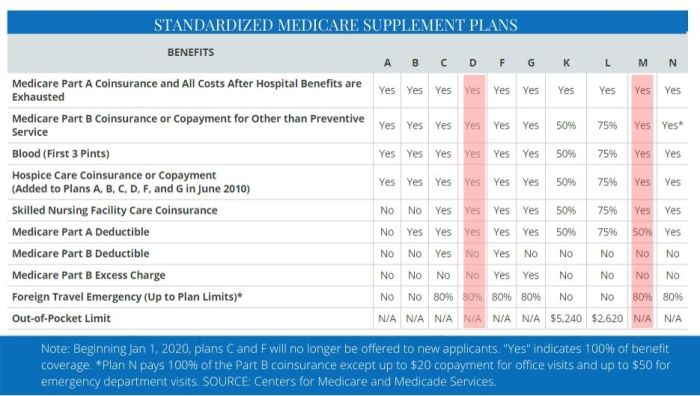

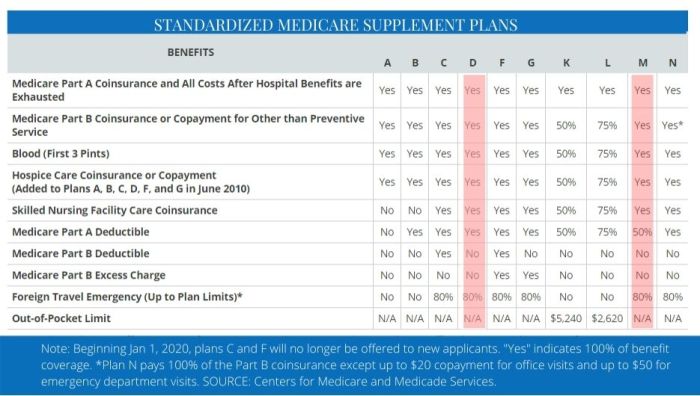

Coverage Provided by Humana Supplement Plans

Humana supplement plans provide coverage for a variety of medical expenses, including:

- Hospital expenses: This includes coverage for inpatient hospital stays, including room and board, as well as certain medical services provided during your hospital stay.

- Doctor’s visits: Humana supplement plans can help cover the costs of visits to your primary care physician, specialists, and other healthcare providers.

- Outpatient services: This includes coverage for services received outside of a hospital setting, such as lab tests, X-rays, and physical therapy.

- Prescription drugs: Some Humana supplement plans may offer coverage for prescription drugs, although this is not a standard benefit across all plans.

- Other benefits: Depending on the specific plan, Humana supplement plans may offer additional benefits such as coverage for emergency services, ambulance transportation, and blood transfusions.

Limitations and Exclusions of Humana Supplement Plans

While Humana supplement plans offer valuable coverage, it’s important to note that they also have limitations and exclusions. Some common limitations include:

- Pre-existing conditions: Some Humana supplement plans may have waiting periods or exclusions for pre-existing conditions. This means that you may not be able to receive full coverage for certain conditions until you have been enrolled in the plan for a specific period.

- Waiting periods: Some benefits, such as coverage for certain medical procedures, may have waiting periods before they become effective. This means you may need to pay out-of-pocket for these services for a certain period of time before your coverage kicks in.

- Coverage caps: Some Humana supplement plans may have coverage caps, which means there is a maximum amount that the plan will pay for certain services. This means you may be responsible for any costs exceeding the coverage cap.

- Limited coverage for certain services: Humana supplement plans may have limited coverage for certain services, such as long-term care, dental care, and vision care.

Humana Supplement Plan Coverage and Exclusions Table

The following table summarizes the key coverage and exclusions of different Humana supplement plans:

| Humana Supplement Plan | Coverage | Exclusions |

|---|---|---|

| Plan A | Covers most out-of-pocket expenses associated with Original Medicare | May have waiting periods for certain benefits |

| Plan B | Similar coverage to Plan A, but also covers the Part B deductible | May have coverage caps for certain services |

| Plan C | Similar coverage to Plan B, but also covers the Part A deductible and coinsurance | May have limited coverage for certain services |

| Plan D | Similar coverage to Plan C, but also covers the Part B excess charges | May have waiting periods for pre-existing conditions |

| Plan F | Covers all out-of-pocket expenses associated with Original Medicare | Not available for new enrollees after January 1, 2020 |

| Plan G | Covers all out-of-pocket expenses associated with Original Medicare, except for the Part B deductible | May have coverage caps for certain services |

| Plan K | Covers all out-of-pocket expenses associated with Original Medicare, except for the Part B deductible and a portion of other costs | May have limited coverage for certain services |

| Plan L | Covers all out-of-pocket expenses associated with Original Medicare, except for the Part B deductible and a larger portion of other costs | May have waiting periods for certain benefits |

Humana Supplement Plan Customer Service and Support

Humana understands the importance of providing excellent customer service and support to its supplement plan holders. They offer a variety of channels for plan holders to access assistance, including phone, email, and online chat. Humana also provides several resources to help plan holders manage their accounts and understand their coverage.

Customer Service Channels

Humana offers a variety of customer service channels to ensure plan holders can easily access support.

- Phone: Humana provides a dedicated phone line for supplement plan holders to reach customer service representatives. These representatives are available 24/7 to assist with a wide range of inquiries, including claims, billing, and coverage questions.

- Email: Plan holders can also contact Humana through email. This option allows for detailed inquiries and provides a written record of the communication.

- Online Chat: Humana offers an online chat feature on their website. This allows plan holders to quickly get answers to simple questions or receive assistance with basic account management tasks.

Resources for Supplement Plan Holders

Humana provides several resources to help supplement plan holders manage their accounts and understand their coverage.

- Online Account Management: Humana’s website offers a secure online portal where plan holders can access their account information, including claims history, payment details, and coverage summaries. Plan holders can also update their contact information and make changes to their plan through the online portal.

- Claim Status Tracking: Through the online portal, plan holders can track the status of their claims. This feature provides real-time updates on the progress of the claim, including any required documentation or next steps.

- FAQs: Humana’s website includes a comprehensive FAQs section that addresses common questions about supplement plans, claims, billing, and other important topics. This resource can provide quick answers to basic questions and help plan holders navigate the complexities of their coverage.

Customer Service Experiences

Many Humana supplement plan holders have shared positive experiences with Humana’s customer service.

“I was impressed with the responsiveness of Humana’s customer service team. I had a question about my coverage and received a prompt and helpful response from a representative.”

“I recently needed to file a claim and found the process to be very straightforward. The representative I spoke with was knowledgeable and patient, and I was able to get my claim processed quickly.”

Humana Supplement Plan Alternatives: Humana Supplement Plans

Humana supplement plans, also known as Medigap plans, can be a valuable addition to Original Medicare, but they aren’t the only option for filling coverage gaps. Several alternative health insurance plans can also meet your healthcare needs, each with its own advantages and drawbacks. Let’s explore these alternatives and compare them to Humana supplement plans to help you make an informed decision.

Comparison of Humana Supplement Plans with Other Health Insurance Options

Understanding the different options available to you is crucial when choosing the right health insurance plan. The table below compares Humana supplement plans with other popular health insurance alternatives, highlighting key features and considerations.

| Plan Type | Cost | Coverage | Flexibility |

|---|---|---|---|

| Humana Supplement Plans | Typically higher premiums, but predictable and consistent | Covers Original Medicare’s out-of-pocket costs, including deductibles, coinsurance, and copayments | Limited flexibility; plan options are standardized by the government |

| Individual Health Insurance | Premiums can vary widely based on factors like age, health, and location | Offers comprehensive coverage, including preventive care, hospitalization, and prescription drugs | Greater flexibility in choosing plans and providers |

| Employer-Sponsored Plans | Premiums often subsidized by the employer, but may have higher deductibles or copayments | Typically offer comprehensive coverage, including preventive care, hospitalization, and prescription drugs | Limited flexibility; plan options and providers are often restricted |

| Medicare Advantage | Premiums can be lower than Original Medicare, but coverage may be more limited | Offers comprehensive coverage, including prescription drugs, and may include additional benefits like dental or vision | Limited flexibility; plan options and providers are restricted to the plan’s network |

Future Trends in Humana Supplement Plans

The healthcare landscape is constantly evolving, driven by factors such as healthcare reform, technological advancements, and shifting consumer preferences. These forces are shaping the future of Humana supplement plans, leading to new offerings, enhanced benefits, and innovative approaches to healthcare delivery.

Impact of Healthcare Reform and Technological Advancements

Healthcare reform initiatives and technological advancements are fundamentally altering the healthcare industry, creating opportunities and challenges for Humana supplement plans.

- The Affordable Care Act (ACA) has expanded health insurance coverage to millions of Americans, leading to increased competition in the insurance market. Humana supplement plans are likely to adapt to this evolving landscape by offering more competitive premiums and benefits to attract customers.

- Technological advancements, such as telemedicine and wearable health devices, are changing how healthcare is accessed and delivered. Humana supplement plans are likely to incorporate these technologies to provide more personalized and convenient healthcare experiences. For instance, Humana may offer telehealth consultations as a covered benefit, enabling members to consult with healthcare providers remotely.

- The increasing adoption of value-based care models, which emphasize quality over quantity, is also influencing the design of Humana supplement plans. Humana may focus on offering plans that incentivize preventive care and health management, promoting overall well-being and reducing healthcare costs.

Emerging Trends in the Supplement Insurance Market

The supplement insurance market is witnessing several emerging trends, including personalized plans and telehealth integration. These trends are likely to influence Humana supplement plans in the future.

- Personalized plans are gaining popularity as consumers seek coverage tailored to their specific needs and health conditions. Humana may offer customized supplement plans that address individual risk profiles and health goals. For example, Humana could offer plans with enhanced coverage for specific conditions like diabetes or cardiovascular disease.

- Telehealth integration is becoming increasingly common in supplement plans, providing members with convenient and accessible healthcare options. Humana may offer telehealth consultations as a covered benefit, allowing members to consult with healthcare providers remotely. This could be particularly beneficial for individuals in rural areas or those with limited mobility.

Predictions about the Future Direction of Humana Supplement Plans

Based on current trends and market dynamics, Humana supplement plans are likely to evolve in several ways.

- Humana may offer more comprehensive plans that cover a wider range of healthcare services, including preventive care, wellness programs, and alternative therapies. This approach aims to address the growing demand for holistic healthcare and promote long-term health management.

- Humana may leverage data analytics and artificial intelligence (AI) to personalize plan recommendations and improve risk assessment. This can help Humana develop more targeted and effective plans that cater to individual needs and health conditions.

- Humana may expand its network of providers to include telehealth services and other innovative healthcare options. This will enhance the accessibility and convenience of healthcare for members, especially those in underserved areas.

Choosing the right Humana supplement plan is a crucial decision that requires careful consideration of your individual needs and financial situation. By understanding the various plan options, coverage details, and costs, you can make an informed choice that best aligns with your healthcare goals. Remember, Humana provides comprehensive resources and support to help you navigate the enrollment process and manage your plan effectively.

Humana supplement plans can help cover costs not covered by traditional Medicare, providing peace of mind for seniors. For those needing dental coverage, Humana also offers a dedicated humana dental insurance company to help manage dental expenses. With a comprehensive approach to healthcare, Humana supplement plans and dental insurance can work together to address a wide range of needs, offering a comprehensive solution for overall health and well-being.