Easy online car insurance has revolutionized the way we obtain coverage. Gone are the days of tedious paperwork and phone calls; now, with just a few clicks, you can compare quotes, customize your policy, and secure the protection you need. This convenience has made insurance accessible to a wider audience, while also offering a more transparent and efficient experience.

Table of Contents

The appeal of online car insurance lies in its user-friendly interfaces, transparent pricing, and the ability to manage your policy anytime, anywhere. Online platforms often offer a wider range of coverage options, allowing you to tailor your policy to your specific needs and budget. Furthermore, the ease of comparison shopping can lead to significant savings, as you can quickly compare quotes from multiple providers and choose the best deal.

Understanding the Appeal of Easy Online Car Insurance

In today’s fast-paced world, convenience is key. Online car insurance has emerged as a popular choice for many drivers, offering a streamlined and efficient way to secure coverage. But what exactly makes it so appealing?

Factors Contributing to the Appeal of Online Car Insurance

The allure of online car insurance lies in its ability to simplify the process for customers, offering several key benefits over traditional methods.

- Convenience: One of the most significant advantages is the ease of access. You can obtain quotes, compare policies, and purchase coverage entirely online, at your convenience, eliminating the need for phone calls or in-person visits. Imagine getting a quote while sipping your morning coffee or comparing policies during your lunch break. Online car insurance allows you to manage your insurance needs on your own time.

- Speed: Online platforms often offer instant quotes, allowing you to quickly compare different options and make an informed decision. The entire process, from obtaining a quote to purchasing coverage, can be completed in a matter of minutes, saving you valuable time and effort. Imagine getting your car insurance sorted within your lunch break, rather than spending hours on the phone or at an insurance office.

- Transparency: Online platforms provide clear and concise information about policy details, coverage options, and pricing. You can easily compare different policies side-by-side, ensuring you understand the terms and conditions before making a decision. Imagine having all the necessary information at your fingertips, empowering you to make an informed choice about your insurance coverage.

- Cost-Effectiveness: Online insurance companies often offer competitive rates due to their lower operating costs compared to traditional insurance providers. They also offer various discounts, such as safe driving bonuses or multi-policy discounts, which can further reduce your premiums. Imagine finding a policy that fits your budget and needs, potentially saving you money in the process.

Key Features of Easy Online Car Insurance Platforms

Online car insurance platforms have revolutionized the way people purchase and manage their car insurance policies. These platforms offer a range of features that simplify the process, making it more convenient and efficient for policyholders.

User-Friendly Interface and Navigation

A key feature of easy online car insurance platforms is their user-friendly interface and intuitive navigation. These platforms are designed with the average user in mind, making it easy for anyone to navigate and understand the process. They often feature clear and concise language, simple menus, and straightforward forms. This ensures that users can easily find the information they need and complete the necessary steps without encountering any confusion or frustration.

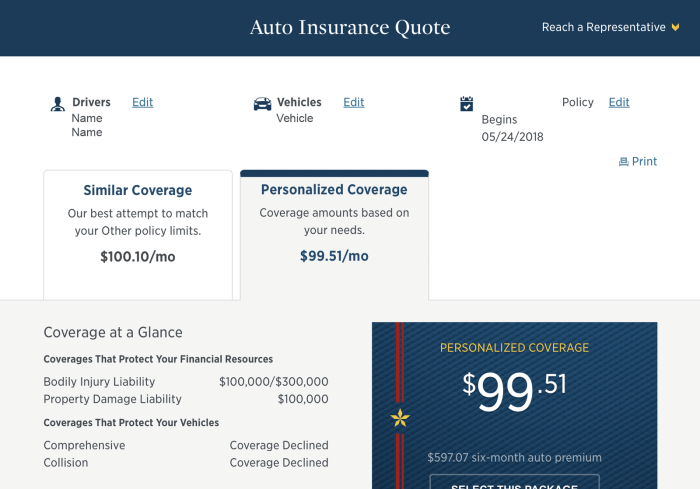

Personalized Quotes and Policy Options

Online car insurance platforms utilize advanced algorithms and data analysis to provide personalized quotes and policy options tailored to individual needs. Users can enter their information, such as driving history, vehicle details, and desired coverage, and receive customized quotes within minutes. This personalized approach allows users to compare different options and choose the most suitable coverage for their specific circumstances.

Instant Policy Management

Easy online car insurance platforms empower users to manage their policies efficiently and conveniently. Policyholders can access their policy details, make changes, pay premiums, and file claims all from a single platform. This eliminates the need for phone calls, emails, or visits to physical offices, saving time and effort. Many platforms also offer mobile apps for even greater accessibility.

Transparent Pricing and Coverage Information

Online car insurance platforms prioritize transparency by providing clear and detailed information about pricing and coverage options. Users can easily understand the cost of different coverage levels, deductibles, and add-ons. This transparency empowers users to make informed decisions about their insurance needs.

24/7 Support and Assistance

Despite the convenience of online platforms, users may still require assistance or have questions. Easy online car insurance platforms provide 24/7 customer support through various channels, such as live chat, email, or phone. This ensures that users can get help whenever they need it, regardless of the time of day or day of the week.

Data Security and Privacy

Online car insurance platforms prioritize data security and privacy to protect users’ sensitive information. They employ advanced encryption technologies and security protocols to safeguard personal data from unauthorized access. Users can rest assured that their information is secure and handled responsibly.

Comparison Table of Popular Online Car Insurance Platforms

| Platform | User-Friendly Interface | Personalized Quotes | Instant Policy Management | Transparent Pricing | 24/7 Support | Data Security |

|---|---|---|---|---|---|---|

| Geico | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent |

| Progressive | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent |

| State Farm | Good | Good | Good | Good | Good | Good |

| Allstate | Good | Good | Good | Good | Good | Good |

| Liberty Mutual | Good | Good | Good | Good | Good | Good |

The Online Car Insurance Quote Process

Obtaining a car insurance quote online is a straightforward process that allows you to compare rates from different insurers conveniently. This process typically involves a series of steps, from providing basic information to receiving a personalized quote.

The accuracy of your online car insurance quote heavily relies on the data you input. The more accurate and comprehensive your information, the more precise your quote will be. Online platforms streamline the quote process by automating data collection and calculations, resulting in faster and more efficient quote generation.

Data Input and Quote Accuracy

Providing accurate information is crucial for receiving an accurate car insurance quote. This data includes your personal details, vehicle information, and driving history.

- Personal Details: This includes your name, address, date of birth, and contact information. Accurate personal details ensure that the insurer can identify you correctly and verify your identity.

- Vehicle Information: This includes the make, model, year, and VIN of your vehicle. This information helps the insurer assess the risk associated with your vehicle, including its value and safety features.

- Driving History: This includes your driving record, including any accidents, violations, or claims. This information is crucial for the insurer to assess your driving risk and determine your premium.

By providing accurate data, you help the insurer accurately assess your risk profile, resulting in a more accurate and personalized quote.

Streamlining the Quote Process

Online car insurance platforms are designed to simplify the quote process, making it quick and convenient. They use automated systems to collect and process data, eliminating the need for manual paperwork and phone calls.

- Automated Data Collection: Online platforms use forms and drop-down menus to collect data efficiently. This eliminates the need for manual data entry, reducing errors and saving time.

- Instant Quote Generation: Once you submit your information, online platforms use algorithms to calculate your quote instantly. This allows you to compare quotes from multiple insurers within minutes.

- Real-time Comparison: Online platforms often allow you to compare quotes from multiple insurers side by side. This feature helps you easily identify the best deals and choose the most suitable policy.

These features streamline the quote process, making it more efficient and user-friendly for consumers.

Factors Influencing Online Car Insurance Rates: Easy Online Car Insurance

Online car insurance rates are determined by a complex interplay of factors, carefully analyzed by algorithms to assess risk and calculate premiums. Understanding these factors empowers you to make informed decisions and potentially secure more favorable rates.

Factors Determining Online Car Insurance Rates

The factors influencing online car insurance rates can be categorized into several key areas, each contributing to the overall risk assessment.

- Vehicle Information: Your car’s make, model, year, and safety features significantly impact insurance rates. Newer cars with advanced safety systems tend to have lower premiums due to their lower risk of accidents and repair costs.

- Driving History: Your driving record plays a crucial role in determining your insurance rates. Accidents, traffic violations, and DUI convictions significantly increase premiums. Maintaining a clean driving record is essential for securing lower rates.

- Location: Your geographic location influences rates due to factors like traffic density, crime rates, and weather conditions. Areas with higher accident rates or severe weather events typically have higher insurance premiums.

- Age and Gender: Statistically, younger and less experienced drivers are more likely to be involved in accidents, leading to higher premiums. Gender can also play a role, as certain demographics have historically shown higher accident rates.

- Credit History: Your credit score can impact your insurance rates in some states. Insurance companies may use credit scores as a proxy for risk, assuming that individuals with poor credit may be more likely to file claims.

- Coverage Options: The type and amount of coverage you choose directly influence your premium. Higher coverage limits and comprehensive policies generally lead to higher premiums.

- Deductibles: Deductibles represent the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you are taking on more financial responsibility in case of an accident.

Impact of Factors on Car Insurance Rates

Here is a table illustrating how different factors can influence your car insurance rates:

| Factor | Impact on Rates | Example |

|---|---|---|

| Vehicle Make and Model | Higher-end or sports cars often have higher premiums due to higher repair costs and perceived risk. | A high-performance sports car like a Porsche 911 will generally have a higher premium than a compact sedan like a Honda Civic. |

| Driving History | Accidents, speeding tickets, and DUI convictions significantly increase premiums. | A driver with a recent DUI conviction will likely face a substantial increase in insurance rates compared to a driver with a clean record. |

| Location | Urban areas with high traffic density and crime rates tend to have higher premiums. | Living in a major city like New York City will generally result in higher insurance rates than living in a rural area with lower traffic density. |

| Age and Gender | Younger drivers and those with less experience often have higher premiums. | A 18-year-old driver will typically pay a higher premium than a 40-year-old driver with a clean record. |

| Credit History | In some states, poor credit scores can lead to higher premiums. | A driver with a low credit score may be offered a higher premium than a driver with excellent credit, even if their driving record is the same. |

| Coverage Options | Higher coverage limits and comprehensive policies generally result in higher premiums. | Choosing full coverage with a higher liability limit will typically lead to a higher premium than choosing minimum coverage with a lower liability limit. |

| Deductibles | Higher deductibles generally result in lower premiums. | Choosing a $1,000 deductible will typically result in a lower premium than choosing a $500 deductible. |

Benefits of Online Car Insurance

The convenience and accessibility of online car insurance platforms have revolutionized the way people obtain and manage their auto insurance. By leveraging technology, these platforms offer a range of advantages over traditional insurance methods, empowering customers to make informed decisions and save time and money.

Accessibility and Convenience

Online car insurance platforms offer unparalleled accessibility and convenience, making it easier than ever to obtain quotes, compare policies, and manage your insurance needs.

- 24/7 Availability: Unlike traditional insurance agencies, online platforms are accessible round-the-clock, allowing you to get quotes, purchase policies, and make changes whenever it’s convenient for you.

- No Geographical Limitations: Online car insurance platforms transcend geographical boundaries, offering their services to customers across the country, eliminating the need to visit a physical office.

- Simplified Application Process: The online application process is typically streamlined and straightforward, requiring minimal paperwork and allowing you to complete the process from the comfort of your home.

Cost-Effectiveness

Online car insurance platforms often offer competitive rates and cost-saving features, making them an attractive option for budget-conscious individuals.

- Lower Overhead Costs: Online platforms have lower overhead costs compared to traditional agencies, allowing them to pass on savings to customers in the form of competitive rates.

- Discount Opportunities: Many online platforms offer a variety of discounts, such as safe driving discounts, multi-policy discounts, and good student discounts, further reducing your insurance premiums.

- Transparent Pricing: Online platforms often provide clear and transparent pricing information, allowing you to compare quotes from different insurers and choose the best option for your needs.

Time Savings

Online car insurance platforms save you valuable time by eliminating the need for in-person meetings and phone calls.

- Instant Quotes: Online platforms provide instant quotes, allowing you to quickly compare different policies and find the best option for your needs.

- Digital Documentation: All documents, including policy documents and claims information, are available online, eliminating the need for paper copies and physical visits to insurance offices.

- Automated Processes: Many online platforms automate key processes, such as policy renewals and claims processing, making the entire experience more efficient and convenient.

Examples of Savings

Online car insurance platforms can save customers significant time and money. For example, a recent study by the Insurance Information Institute found that consumers who purchased car insurance online saved an average of $400 per year compared to those who purchased through traditional channels. Additionally, many online platforms offer tools that allow you to compare quotes from multiple insurers in minutes, helping you find the best deal and save hundreds of dollars annually.

Security and Privacy in Online Car Insurance

In the digital age, safeguarding personal information is paramount, especially when dealing with sensitive financial data like car insurance. Online car insurance platforms understand this and have implemented robust security measures to protect customer information. This section delves into the security practices employed by these platforms and the importance of data privacy in the context of online insurance.

Security Measures Implemented by Online Car Insurance Platforms

Online car insurance platforms employ various security measures to protect customer data from unauthorized access and cyber threats. These measures include:

- Data Encryption: Sensitive information like personal details and financial data is encrypted during transmission and storage, making it unreadable to unauthorized parties. This ensures that even if data is intercepted, it cannot be accessed without the proper decryption key.

- Firewalls and Intrusion Detection Systems: These systems act as barriers to prevent unauthorized access to the platform’s servers and networks. They constantly monitor network traffic for suspicious activity and block any attempts to breach security.

- Multi-Factor Authentication: Many platforms require multi-factor authentication (MFA) for account access, adding an extra layer of security. This involves using two or more authentication factors, such as a password and a one-time code sent to a mobile device, making it harder for unauthorized individuals to gain access.

- Regular Security Audits: Platforms undergo regular security audits by independent third-party experts to identify and address any vulnerabilities. This ensures that security practices are up-to-date and effective in mitigating potential threats.

- Secure Payment Gateways: When making payments, platforms utilize secure payment gateways that encrypt financial data and adhere to industry standards like PCI DSS (Payment Card Industry Data Security Standard). This protects payment information from unauthorized access and fraud.

Importance of Data Privacy and Protection

Data privacy is a fundamental right and a crucial aspect of online car insurance. Platforms are obligated to protect customer information from misuse and unauthorized access. This is achieved through adherence to privacy regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States.

- Transparency and Control: Platforms should be transparent about the data they collect, how they use it, and the choices customers have regarding their data. This includes providing clear privacy policies and allowing customers to access, update, or delete their personal information.

- Data Minimization: Platforms should only collect data that is necessary for providing insurance services and should not collect excessive or irrelevant information. This helps to minimize the risk of data breaches and misuse.

- Data Security and Integrity: Platforms should implement appropriate technical and organizational measures to protect customer data from unauthorized access, alteration, disclosure, or destruction. This includes using secure storage, encryption, and access controls.

Best Practices for Safeguarding Personal Information

While online car insurance platforms implement robust security measures, customers also play a vital role in protecting their personal information. Here are some best practices:

- Use Strong Passwords: Create strong, unique passwords for each online account, including your car insurance platform. Avoid using easily guessable information like birthdays or common words. Consider using a password manager to help generate and store secure passwords.

- Be Cautious of Phishing Attempts: Be wary of suspicious emails or messages requesting personal information. Never click on links in unsolicited emails or provide sensitive data over unsecured websites. If you’re unsure about the legitimacy of a request, contact the insurance platform directly through their official website or phone number.

- Review Privacy Policies: Before providing any personal information, take the time to read the platform’s privacy policy carefully. Understand what data they collect, how they use it, and what your rights are regarding your data.

- Keep Software Updated: Regularly update your operating system, web browser, and antivirus software. Updates often include security patches that address vulnerabilities and protect against malware.

Customer Support and Service

Online car insurance platforms are designed for convenience, but what happens when you need help? Modern platforms offer various support options, making it easier to get assistance when you need it.

Types of Customer Support

Online car insurance platforms provide a range of support channels to cater to different customer preferences. These include:

- Live Chat: This real-time communication tool allows you to connect with a customer service representative directly through the platform. Live chat is ideal for quick questions or immediate assistance.

- Email: Email is a convenient option for non-urgent inquiries, allowing you to provide detailed information and receive a written response. It’s also helpful for documenting conversations.

- Phone Support: Some online car insurance platforms offer phone support, providing a more personal and immediate way to connect with a representative. Phone support is particularly useful for complex issues or when you prefer a voice-based interaction.

- Frequently Asked Questions (FAQs): Comprehensive FAQs sections provide answers to common questions, allowing you to find solutions quickly and independently. These sections are often organized by topic for easy navigation.

- Online Help Center: Online help centers offer a wealth of information, including articles, tutorials, and video guides, covering various aspects of the platform and insurance policies. This resource can be a valuable tool for self-service and understanding your coverage.

Comparing Responsiveness and Efficiency

Online support methods offer several advantages over traditional methods, such as:

- Availability: Online support is typically available 24/7, allowing you to access help at any time, regardless of business hours.

- Speed: Live chat and online help centers provide quick responses, often within minutes, reducing wait times compared to traditional methods.

- Convenience: Online support eliminates the need for phone calls or in-person visits, allowing you to access assistance from anywhere with an internet connection.

Impact on Customer Satisfaction and Retention

Effective customer service is crucial for customer satisfaction and retention in any industry. This is especially true for online car insurance platforms, where customers rely on a seamless and efficient experience.

Excellent customer service can lead to increased customer loyalty and positive word-of-mouth recommendations.

- Faster Resolution: Efficient online support helps resolve issues quickly, reducing frustration and increasing customer satisfaction.

- Personalized Experience: Online platforms can leverage data to personalize support interactions, tailoring responses to individual needs and preferences.

- Proactive Communication: Platforms can use online channels to proactively inform customers about important updates, policy changes, or potential issues, fostering trust and transparency.

Tips for Saving Money on Online Car Insurance

Finding the best car insurance rates online can be a challenge, but it doesn’t have to be a daunting task. With a little research and some smart strategies, you can significantly reduce your premiums and save money in the long run.

Exploring Discounts and Bundling

Discounts and bundling are key strategies for lowering your car insurance costs. Insurance companies offer a variety of discounts based on factors like your driving history, vehicle safety features, and even your profession. Bundling your car insurance with other policies, such as homeowners or renters insurance, can also lead to substantial savings.

- Good Driver Discounts: These discounts are awarded to drivers with clean driving records, typically without accidents or traffic violations.

- Safe Vehicle Discounts: Cars equipped with advanced safety features like anti-theft systems, airbags, and anti-lock brakes often qualify for discounts.

- Multi-Policy Discounts: Bundling your car insurance with other policies like homeowners, renters, or life insurance can lead to significant savings.

- Student Discounts: Good students, especially those with high GPAs, might qualify for discounts.

- Loyalty Discounts: Many insurers offer discounts to customers who have been with them for a certain period.

Negotiating Rates and Leveraging Online Tools

Negotiating your car insurance rates is a crucial step in saving money. Don’t be afraid to haggle with insurance companies, especially if you have a clean driving record and have been with them for a while.

- Shop Around and Compare Quotes: Online insurance comparison websites are a great resource for comparing quotes from different insurers. These platforms allow you to enter your details once and receive quotes from multiple providers, making it easier to find the best deal.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can significantly lower your premium. However, make sure you can afford the deductible if you need to file a claim.

- Review Your Coverage: Assess your current coverage and determine if you need all the features. Some coverage, like collision or comprehensive, might be unnecessary if your car is older or has a lower value.

- Ask for Discounts: Don’t hesitate to ask your insurer about any available discounts you might qualify for. Some discounts might not be advertised, so it’s always worth inquiring.

- Negotiate with Your Current Insurer: If you’ve been a loyal customer with a good driving record, don’t be afraid to negotiate with your current insurer. They might be willing to offer you a better rate to retain your business.

The Future of Online Car Insurance

The online car insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. As technology continues to shape the way we live, work, and interact with the world, it’s also transforming the way we purchase and manage our insurance. The future of online car insurance holds exciting possibilities for both consumers and insurance providers, promising greater convenience, personalization, and cost-effectiveness.

Emerging Trends and Innovations, Easy online car insurance

The online car insurance industry is experiencing a surge of innovation, driven by the desire to provide a more seamless and personalized experience for customers.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming the insurance landscape by automating tasks, improving risk assessment, and personalizing pricing. AI-powered chatbots are becoming increasingly popular for customer service, while ML algorithms can analyze driving data and predict future risk, leading to more accurate and personalized pricing.

- Telematics: Telematics devices and smartphone apps are revolutionizing the way insurance companies assess risk. These devices collect data on driving behavior, such as speed, braking, and mileage, allowing insurers to offer discounts to safe drivers. Telematics also enables real-time monitoring and alerts, improving safety and potentially reducing claims.

- Blockchain Technology: Blockchain technology has the potential to disrupt the insurance industry by providing a secure and transparent platform for transactions. It can streamline claims processing, reduce fraud, and enable new types of insurance products. For example, blockchain could be used to create a decentralized insurance marketplace where consumers can directly access and compare quotes from multiple insurers.

- Internet of Things (IoT): The increasing adoption of connected devices, such as smart homes and vehicles, is creating new opportunities for insurance providers. IoT devices can provide real-time data on risks, enabling insurers to offer personalized policies and preventive measures. For example, a smart home system could detect a leak and automatically notify the insurer, reducing the potential for costly water damage.

Conclusion

The rise of easy online car insurance platforms has revolutionized the way people shop for and manage their car insurance. These platforms offer numerous advantages, including convenience, transparency, and often, lower premiums.

Key Takeaways and Recommendations

The convenience of comparing quotes, purchasing policies, and managing accounts online has become increasingly appealing to consumers. Easy online car insurance platforms have simplified the process, making it accessible to a wider audience. However, it’s crucial to remember that not all platforms are created equal.

- Do your research: Compare quotes from multiple providers and carefully review policy details before making a decision.

- Read the fine print: Pay attention to deductibles, coverage limits, and exclusions to ensure you understand the terms of your policy.

- Consider your needs: Evaluate your driving history, vehicle type, and coverage requirements to determine the most suitable policy.

- Seek professional advice: If you have questions or require assistance, don’t hesitate to contact a licensed insurance agent or broker.

Navigating the world of online car insurance can be empowering. By understanding the key features, benefits, and factors that influence rates, you can make informed decisions and secure the best possible coverage for your needs. Remember to prioritize security and privacy, compare providers carefully, and utilize the tools and resources available to save money. The future of car insurance is increasingly digital, offering convenience and control like never before.

Getting affordable car insurance online is a breeze these days, with many companies offering quick quotes and easy application processes. And just like securing your car with insurance, taking care of your health is equally important. Check out the humana preventive plus program for comprehensive health coverage. With the right insurance, you can drive with peace of mind, knowing you’re protected on the road and in life.