Easy auto insurance online has become a popular choice for drivers seeking a convenient and affordable way to secure their vehicle coverage. The digital age has revolutionized the insurance industry, offering a streamlined process for obtaining quotes, comparing options, and managing policies.

Table of Contents

With online platforms, you can access a wide range of insurance providers, compare coverage options, and get instant quotes without leaving the comfort of your home. This convenience has made online auto insurance increasingly attractive, especially for busy individuals who value efficiency and transparency.

The Appeal of Online Auto Insurance

The convenience and affordability of online auto insurance have made it a popular choice for many drivers. Obtaining insurance online offers numerous benefits compared to traditional methods, making it a compelling option for those seeking a streamlined and cost-effective approach to securing their vehicle coverage.

Convenience and Accessibility

Online platforms offer a high degree of convenience and accessibility, making it easy for individuals to obtain quotes, compare policies, and purchase insurance from the comfort of their own homes. This contrasts with traditional insurance brokers, who often require in-person meetings or phone calls, which can be time-consuming and inconvenient.

- 24/7 Availability: Online insurance platforms are available 24/7, allowing individuals to access quotes and purchase policies at any time, regardless of business hours.

- Simplified Application Process: Online applications are typically streamlined and user-friendly, requiring minimal paperwork and eliminating the need for physical signatures.

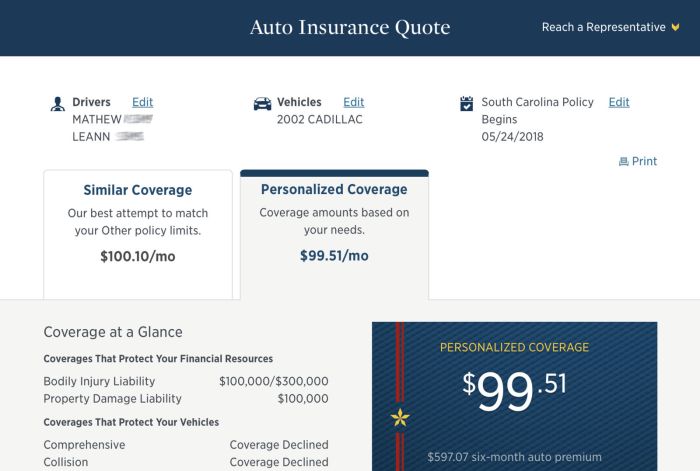

- Instant Quotes: Online platforms provide instant quotes based on the user’s information, allowing for quick comparisons and decision-making.

Competitive Pricing and Transparency

Online insurance companies often offer competitive pricing due to lower overhead costs associated with operating online. They can also provide greater transparency regarding policy details and pricing, enabling individuals to make informed decisions.

- Direct-to-Consumer Model: Online insurance providers operate on a direct-to-consumer model, eliminating the need for intermediaries and associated fees, which can result in lower premiums.

- Price Comparison Tools: Online platforms often provide price comparison tools that allow individuals to compare quotes from multiple insurers side-by-side, ensuring they get the best possible rate.

- Detailed Policy Information: Online platforms offer detailed information about their policies, including coverage details, deductibles, and exclusions, promoting transparency and understanding.

Growing Popularity of Online Auto Insurance

The popularity of online auto insurance continues to rise due to several factors, including:

- Increased Internet Penetration: The widespread adoption of the internet and mobile devices has made it easier for individuals to access online services, including insurance.

- Consumer Demand for Convenience: Consumers are increasingly seeking convenient and efficient solutions, and online platforms meet this demand by offering a streamlined and accessible experience.

- Technological Advancements: Advancements in technology have enabled the development of sophisticated online platforms that provide a seamless and user-friendly experience.

Finding the Right Online Auto Insurance Provider

Navigating the world of online auto insurance can feel overwhelming, with numerous providers vying for your attention. Finding the right provider is crucial to securing affordable and comprehensive coverage that meets your specific needs. This process involves careful consideration of various factors and a thorough comparison of options.

Key Factors to Consider

It’s important to evaluate potential providers based on a set of key factors to ensure you’re making an informed decision. This checklist can help guide your selection:

- Coverage Options: Different providers offer varying levels of coverage, such as liability, collision, comprehensive, and uninsured motorist. Determine the coverage options that best suit your needs and compare them across providers.

- Pricing and Discounts: Price is a significant factor for most consumers. Compare quotes from multiple providers and consider available discounts, such as safe driving records, good student discounts, and multi-car policies. Look for transparent pricing structures with clear explanations of fees and charges.

- Customer Service and Claims Handling: Consider the provider’s reputation for customer service and claims handling. Look for providers with positive reviews and testimonials, and investigate their processes for filing and resolving claims. Efficient and responsive customer support can make a significant difference during stressful situations.

- Financial Stability and Ratings: Check the financial stability and ratings of potential providers. Reputable rating agencies, such as AM Best and Standard & Poor’s, assess the financial strength of insurance companies. Choosing a financially sound provider ensures they can fulfill their obligations in case of a claim.

- Technology and User Experience: Online insurance providers often offer digital tools and platforms for managing policies, paying premiums, and filing claims. Evaluate the user-friendliness and accessibility of these platforms, ensuring they meet your technological preferences and requirements.

Comparing Quotes from Multiple Providers

Comparing quotes from multiple providers is crucial to finding the best possible price for your auto insurance. Online comparison tools and websites simplify this process by allowing you to enter your information once and receive quotes from various providers.

- Online Comparison Tools: Websites like Policygenius, The Zebra, and Insurify allow you to compare quotes from multiple providers simultaneously, saving you time and effort. These tools often provide detailed information about coverage options, pricing, and provider ratings.

- Direct Provider Websites: Visit the websites of individual insurance providers to obtain quotes directly. This allows you to explore their specific offerings and compare them to quotes from other providers.

- Insurance Brokers: Consider working with an independent insurance broker who can compare quotes from multiple providers on your behalf. Brokers often have access to a wider range of providers and can provide expert advice on choosing the right coverage.

The Role of Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the experiences of other customers with a particular insurance provider. These reviews can offer valuable perspectives on customer service, claims handling, and overall satisfaction.

- Online Review Platforms: Websites like Trustpilot, Yelp, and Google Reviews offer a platform for customers to share their experiences with insurance providers. Reading reviews can help you identify potential red flags and gauge the provider’s overall reputation.

- Industry Ratings: Rating agencies like J.D. Power and Consumer Reports provide independent assessments of insurance providers based on customer satisfaction and claims handling. These ratings can provide valuable insights into the overall performance of a provider.

The Online Application Process

Applying for auto insurance online is a convenient and straightforward process. It allows you to compare quotes, select coverage, and purchase your policy all from the comfort of your home.

Steps Involved in the Online Application Process

The online application process typically involves several steps. It is important to understand these steps to ensure a smooth and successful application.

- Provide Basic Information: You’ll start by entering your personal information, including your name, address, date of birth, and contact details. This information is essential for the insurance company to identify you and process your application.

- Enter Vehicle Details: Next, you’ll provide details about your vehicle, such as the make, model, year, and VIN (Vehicle Identification Number). This information helps the insurance company assess the risk associated with insuring your vehicle.

- Select Coverage Options: You’ll then choose the type and amount of coverage you want. This includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. You can adjust your coverage options based on your individual needs and budget.

- Provide Driving History: The insurance company will ask for your driving history, including any accidents, violations, or driving convictions. This information helps them assess your risk as a driver.

- Submit Payment Information: Finally, you’ll provide your payment information, such as your credit card or bank account details. This is used to pay your premium.

Tips for Completing the Application Accurately and Efficiently

Following these tips can help you complete your application accurately and efficiently.

- Gather Necessary Documents: Before starting the application, gather all the necessary documents, including your driver’s license, vehicle registration, and proof of insurance (if applicable). This will help you complete the application quickly and avoid any delays.

- Read the Fine Print: Carefully review the terms and conditions of the policy before submitting your application. This will ensure you understand the coverage you’re purchasing and any exclusions or limitations.

- Double-Check Your Information: Before submitting your application, double-check all the information you’ve entered to ensure it is accurate. Errors in your application can lead to delays or problems with your coverage.

- Contact Customer Support: If you have any questions or need assistance during the application process, contact the insurance company’s customer support team. They can help you understand the application process and address any concerns.

Importance of Providing Accurate Information and Documentation

Providing accurate information and documentation is crucial for several reasons.

- Accurate Coverage: Accurate information ensures that you receive the appropriate coverage for your needs. If you provide incorrect information, your coverage may not be adequate in the event of an accident or other claim.

- Avoid Policy Cancellation: Providing inaccurate information can lead to your policy being canceled. Insurance companies have the right to cancel policies if they discover that the information provided was false or misleading.

- Maintain a Good Driving Record: Accurate information helps you maintain a good driving record. This can help you qualify for lower premiums in the future.

Understanding Coverage Options

When you’re shopping for auto insurance online, you’ll encounter a variety of coverage options. It’s essential to understand what each coverage type offers and how it can protect you in different scenarios.

Types of Auto Insurance Coverage

Different types of auto insurance coverage protect you against various risks associated with owning and operating a vehicle. These coverages can be bundled together in a policy or purchased individually based on your needs and preferences.

- Liability Coverage: This is the most common type of auto insurance and is required by law in most states. Liability coverage protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. It covers the other driver’s medical expenses, property damage, and legal fees. Liability coverage is typically divided into two parts:

- Bodily Injury Liability: This covers the cost of medical expenses, lost wages, and pain and suffering for the other driver and passengers in their vehicle if you are at fault for the accident.

- Property Damage Liability: This covers the cost of repairs or replacement of the other driver’s vehicle or property if you are at fault for the accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is generally recommended if you have a car loan or lease, as lenders often require it.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, fire, or natural disasters. This coverage is optional, but it is generally recommended if you have a newer or more expensive vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. It covers your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of who is at fault. It is also known as “no-fault” insurance. This coverage is mandatory in some states and optional in others.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who is at fault for the accident. It is a less comprehensive coverage than PIP.

Factors Influencing Coverage Costs

The cost of auto insurance coverage can vary significantly based on several factors. Understanding these factors can help you make informed decisions about your coverage options and potentially save money.

- Driving Record: Your driving history plays a significant role in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, accidents, speeding tickets, and DUI convictions can significantly increase your rates.

- Vehicle Type: The make, model, year, and safety features of your vehicle can impact your insurance premiums. Newer, more expensive vehicles with advanced safety features generally cost more to insure than older, less expensive vehicles.

- Location: Your location can influence your insurance rates due to factors such as traffic density, crime rates, and the cost of living in your area. Areas with higher traffic density and crime rates may have higher insurance premiums.

- Age and Gender: Younger drivers, particularly those under 25, often pay higher insurance premiums due to their higher risk of accidents. Gender can also play a role in insurance rates, with women generally paying lower premiums than men.

- Credit Score: In some states, insurance companies use your credit score to determine your insurance rates. Drivers with good credit scores typically receive lower premiums.

- Coverage Levels: The amount of coverage you choose can also impact your insurance premiums. Higher coverage limits generally result in higher premiums.

Examples of Common Coverage Options and Their Benefits

Here are some examples of common coverage options and their benefits:

- Collision Coverage: If you have a car loan or lease, collision coverage is essential. It will cover the cost of repairs or replacement of your vehicle if it is damaged in an accident, even if you are at fault. This coverage is important because it protects you from financial hardship if your vehicle is totaled or severely damaged.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters. It is particularly important for newer or more expensive vehicles. If your vehicle is damaged by something other than an accident, comprehensive coverage will cover the cost of repairs or replacement.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial because it protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. It can help you recover medical expenses, lost wages, and property damage costs.

Managing Your Policy Online

One of the biggest advantages of online auto insurance is the convenience it offers for managing your policy. You can access and manage your policy details anytime, anywhere, through a user-friendly online portal. This includes viewing your policy documents, making changes, and even paying your premiums.

Policy Management Features, Easy auto insurance online

Online auto insurance platforms offer a wide range of features to simplify policy management. These features are designed to make your insurance experience more efficient and user-friendly.

- Policy Document Access: You can access your policy documents, including your declarations page, coverage details, and payment history, directly from your online account. This eliminates the need for physical copies and allows you to easily review your policy information whenever needed.

- Payment Management: Online platforms allow you to manage your payments, including viewing your payment history, setting up automatic payments, and making one-time payments. This ensures you stay on top of your premiums and avoid late payment fees.

- Policy Changes: You can make changes to your policy, such as adding a driver, changing coverage, or updating your contact information, directly through your online account. This saves you time and eliminates the need to contact your insurance agent or call customer service.

- Claims Reporting: Most online insurance platforms offer a convenient way to report claims online. You can submit details about your accident, upload supporting documents, and track the status of your claim through your online account.

Making Changes to Your Policy

Making changes to your online auto insurance policy is often a straightforward process. Here’s a general overview:

- Log in to your account: Access your online account using your username and password.

- Navigate to the policy management section: Look for a section dedicated to managing your policy. This might be labeled “My Policy,” “Policy Details,” or something similar.

- Select the desired change: Choose the specific change you want to make. For example, you might click on “Add Driver,” “Change Coverage,” or “Update Contact Information.”

- Provide the necessary information: Enter the required details, such as the driver’s information, coverage details, or updated contact information.

- Review and submit: Carefully review the changes you’ve made and submit your request. You’ll often receive a confirmation email or notification within your account.

Benefits of Online Policy Management

Managing your auto insurance policy online offers several benefits, including:

- Convenience: Accessing and managing your policy online is convenient and time-saving, as you can do it anytime, anywhere.

- Efficiency: Online platforms streamline the policy management process, eliminating the need for paperwork and phone calls.

- Transparency: You have clear visibility into your policy details, including coverage options, payment history, and claim status.

- Security: Online platforms often use secure encryption and authentication measures to protect your personal information.

The Role of Technology in Online Auto Insurance

Technology has dramatically transformed the auto insurance industry, making it more accessible, efficient, and personalized for consumers. The rise of online platforms has simplified the process of obtaining quotes, comparing policies, and managing insurance needs.

Data Analytics and Artificial Intelligence in Pricing and Risk Assessment

Data analytics and artificial intelligence (AI) have revolutionized how insurance companies assess risk and determine premiums. By analyzing vast amounts of data, including driving records, demographics, vehicle information, and even telematics data, AI algorithms can create highly accurate risk profiles for individual policyholders. This allows for more personalized pricing, where drivers with lower risk profiles benefit from lower premiums, while those with higher risk profiles may pay slightly more.

The use of AI in risk assessment can help to reduce bias and improve fairness in pricing, ensuring that premiums reflect individual driving behavior and risk factors.

The Impact of Telematics and Usage-Based Insurance

Telematics, the use of technology to track and analyze driving behavior, has introduced usage-based insurance (UBI) models. These models allow insurers to offer premiums based on actual driving habits, such as speed, braking, mileage, and time of day.

- Drivers who exhibit safe driving habits, such as avoiding hard braking and speeding, can earn discounts on their premiums.

- UBI programs also encourage safer driving practices, leading to a reduction in accidents and overall insurance costs.

Security and Privacy Considerations: Easy Auto Insurance Online

When you choose to buy auto insurance online, you’re entrusting your personal information to the provider. It’s crucial to understand how this information is protected and what steps you can take to ensure your privacy.

Online auto insurance providers handle sensitive data, including your name, address, driving history, and financial details. It’s essential that they take the necessary measures to safeguard this information.

Data Security Measures

Online auto insurance providers employ various security measures to protect your data. These measures include:

- Encryption: Data is encrypted during transmission, meaning it’s converted into an unreadable format, making it difficult for unauthorized individuals to access it. This is similar to sending a letter in a sealed envelope.

- Firewalls: Firewalls act as barriers, preventing unauthorized access to the provider’s systems. They work like security guards, keeping unwanted visitors out.

- Regular Security Audits: Providers conduct regular security audits to identify and address potential vulnerabilities. This is like a regular checkup for the system, ensuring everything is running smoothly and securely.

- Two-Factor Authentication: This extra layer of security requires you to provide an additional piece of information, like a code sent to your phone, beyond your password. It’s like having an extra key to unlock your account, making it more difficult for unauthorized individuals to access it.

Protecting Your Personal Data

While online providers take steps to protect your data, you can also take steps to safeguard your information.

- Strong Passwords: Use strong passwords that combine uppercase and lowercase letters, numbers, and symbols. This makes it harder for hackers to guess your password.

- Avoid Public Wi-Fi: When purchasing insurance online, use a secure internet connection, especially when entering sensitive information. This is like using a locked door to access your information.

- Be Cautious of Phishing Attempts: Be wary of suspicious emails or websites that request your personal information. This is like being aware of someone trying to trick you into giving them your house key.

- Check the Provider’s Privacy Policy: Read the provider’s privacy policy carefully to understand how they collect, use, and share your data. This is like reading the fine print before signing a contract.

Cost-Saving Strategies

Saving money on your auto insurance is a priority for most drivers. Thankfully, online auto insurance providers offer various cost-saving strategies that can significantly reduce your premiums. By understanding these strategies and implementing them, you can enjoy affordable coverage without compromising on essential protection.

Bundling Insurance Policies

Bundling your insurance policies with the same provider can lead to substantial savings. This means combining your auto insurance with other types of insurance, such as homeowners, renters, or life insurance. By bundling, you benefit from discounts offered by the insurer for consolidating multiple policies. This is a simple yet effective way to reduce your overall insurance costs.

Customer Support and Assistance

Navigating the world of online auto insurance can sometimes require assistance. Fortunately, most online providers offer a variety of customer support options to ensure a smooth and satisfactory experience.

Customer Support Options

Online auto insurance providers typically offer a range of support options to cater to different preferences and situations. These may include:

- Live Chat: Many online insurers provide live chat functionality on their websites, allowing customers to engage in real-time conversations with customer service representatives. This option is particularly useful for quick inquiries or immediate assistance.

- Email Support: Email is another common channel for contacting online insurers. This method is suitable for non-urgent inquiries or situations where a detailed explanation is required.

- Phone Support: While online insurance providers emphasize digital interaction, they often maintain phone lines for customers who prefer voice communication. This option is particularly helpful for complex issues or when immediate assistance is needed.

Future Trends in Online Auto Insurance

The world of auto insurance is rapidly evolving, driven by technological advancements and changing consumer preferences. Online auto insurance has already revolutionized the industry, and the future holds even more exciting possibilities.

The Impact of Autonomous Vehicles and Connected Car Technology

Autonomous vehicles (AVs) and connected car technology are poised to significantly impact the auto insurance landscape.

AVs are expected to reduce accidents drastically due to their advanced safety features and ability to avoid human errors.

This will likely lead to lower insurance premiums for AV owners. Connected car technology allows insurers to collect real-time data on driving behavior, enabling them to offer personalized premiums based on individual driving habits. This shift towards usage-based insurance (UBI) will incentivize safe driving and reward responsible drivers with lower premiums.

The Evolving Role of Insurance Providers in the Digital Age

Insurance providers are adapting to the digital age by embracing technology and offering innovative solutions.

- Personalized Experiences: Online platforms will provide customized experiences based on individual needs and preferences, including tailored coverage options and personalized communication.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will play a crucial role in automating tasks, improving risk assessment, and providing personalized recommendations.

- Data Analytics and Predictive Modeling: Insurance providers will leverage data analytics and predictive modeling to identify risk factors, anticipate future trends, and develop more accurate pricing models.

These advancements will empower insurers to offer more efficient and personalized services, enhancing customer satisfaction and driving innovation.

In conclusion, easy auto insurance online provides a modern and accessible approach to securing the necessary coverage for your vehicle. By leveraging technology and offering user-friendly platforms, online providers have made the process of obtaining auto insurance simpler, faster, and more cost-effective. Whether you’re a tech-savvy individual or simply seeking a hassle-free experience, exploring the options available online can be a wise choice for your insurance needs.

Finding affordable auto insurance online can be a breeze these days, with many comparison websites available. While you’re exploring options, it’s also a good time to consider your healthcare needs. If you’re over 65, you might want to look into humana medicare plan g , which offers comprehensive coverage for seniors. Once you’ve got your insurance sorted, you can focus on enjoying the open road with peace of mind.